Orange County Property Division Lawyer

Orange County Property Division Attorney

The issue of property division can be one of the most contentious areas of an Orange County divorce, and you deserve the fierce advocacy of an Orange County property division lawyer who can help ensure your hard-earned assets remain as intact as possible. At Minyard Morris (formed over 48 years ago), we understand just how uncertain and anxiety-inducing the process of property division can be and hope to offer our aggressive legal representation to ensure you do not walk away empty-handed.

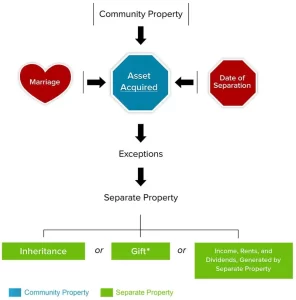

California is a community property state. This means that each spouse owns 50 percent of all assets acquired during the marriage. It also means that if the parties incurred debts, each spouse owes 50 percent of those, also. Although this concept sounds simple, it can be quite complex. Certain assets, like an inheritance or an asset owned before the marriage, will likely be considered separate property and excluded from the community property division.

At Minyard Morris, our 20 Orange County divorce attorneys collaborate relative to complex issues to ensure that community property is divided in accordance with the law. Our team has over 350 years of collective family law experience, including thousands of property division cases. We can assist you with the most complicated high net worth divorces or the more traditional divorces.

Common Types of Property Ownership in Orange County, CA

To enter into negotiations regarding the division of marital property in a divorce case, it is essential that you have a clear understanding of the various forms of property, as there are several definitions that may pertain to the assets you own. The four most common forms of property in Orange County include:

- Community property. This form of property is defined in California as any and all property that was earned during the course of the marriage. Common examples can include the marital home, cars, jewelry, certain bank accounts, and home furnishings.

- Separate property. This type of property encompasses all assets which were gained before the marriage took place. Examples of this might include vehicles purchased before the couple was married or the debt of student loans.

- Quasi-property. The spouses obtained this property while they were not living in a state governed under community property laws. For example, if the divorcing couple purchased property while living in a non-community property state such as North Dakota but have since moved to California, some of the property may be defined as quasi-property.

- Commingled property. The assets included in this form of property are those that started as separate property assets but were turned into shared or marital property. This can include any inherited assets that were deposited into a marital bank account or property that was purchased using marital money.

It is vital to understand the differences in these types of property ownership heading into any divorce case so that you can recognize what you are entitled to in a division of property. Understanding how courts handle dividing retirement assets is crucial when assessing the overall division of property. At Minyard Morris, we are committed to fighting for you and can look for ways to protect the things you have worked so hard to obtain in your life.

Minyard Morris: Protecting Your Interests in an Orange County Divorce

While hiring an attorney to represent your interest in a contested divorce, such as those with issues concerning the division of property, is not legally required, it can be extremely beneficial while seeking a favorable case outcome. At Minyard Morris, we pride ourselves on fighting for the desires of our clients and advocating for their interests with ferocity and excellence.

When you choose to work with our team, you are obtaining a firm that places your interests and goals at the forefront of the case and can strategically plan ways to protect you and advocate for your desired outcome. Our team of family law and divorce attorneys have a vast understanding of California property division law and can provide the necessary guidance throughout your case.

We can work to litigate on your behalf to ensure your rights are protected and you have the peace of mind that comes with knowing your interests are being aggressively advocated for. When you work with the attorneys at Minyard Morris, you can rest assured we will do everything in our power to achieve for you the property division outcome you hope for.

How the Orange County Courts Divide and Award Assets

Courts have wide discretion in both high-asset divorces and more traditional divorces to award assets to each party as they deem appropriate, so long as the awards are equal in value. This does not mean that every asset is equally divided. It means that total assets awarded to each spouse must be equal in value. Courts may award a specific asset to one party based on personal and emotional attachment to the asset, with offsetting assets being awarded to the other party.

The equal division rule has one important exception. Divorce courts have the authority to divide the community property unequally if the estate has a negative net value.

Many types of assets raise complicated problems pertaining to valuation and an equal division, including:

- Separate and comingled assets

- Deferred compensation plans

- Stock options and RSUs

- Business interests

- Real estate

- Individual and business tax issues

- Retirement plans

Protecting Separate Property

In California, separate property includes inheritances, gifts and assets acquired before the date of marriage or after the date of separation. There are many complicated issues related to separate property. For example, when the separate property of one spouse is used for the renovation of a community property home during the marriage or when community property is used to improve or enhance the separate property of one spouse.

The Stages of California Property Division

It is important to have an understanding of the legal process that lies ahead of you regarding the division of property in an Orange County divorce. There are four main steps involved in these situations, including:

- Property identification. First, all property owned by you and your soon-to-be ex-spouse, including that considered marital or separate, will need to be identified. It is essential that no assets are hidden during this process, as this will only hurt the future of your property division case. Your attorney can assist you in this process to ensure all assets and debts are identified and can help you uncover if your spouse is hiding any of these assets.

- Property classification. Then, you and your attorney can begin to classify all debts or assets. In this process, assets and debts will be classified as either marital or separate property, or in some cases, commingled and quasi-property as well.

- Property valuation. Third, your attorney will begin to assign values to the property. To each item of property, your attorney will assign a fair market value, which will be used to determine exactly how this item of property will be divided. At Minyard Morris, we can utilize our extensive resources to seek valuation input from appraisers to ensure that the assigned value is fair and accurate.

- Property distribution. Finally, once the property has all received an assigned value, the property subject to a division will be split between the divorcing couple. While an exact 50/50 split is rarely achieved, the goal of California law is to achieve as equal a split as it pertains to the value of the property as possible.

Alternative Investments

In the intricate landscape of Orange County divorces, especially those involving high-net-worth estates, the division of assets goes beyond the mere allocation of tangible properties like real estate and automobiles. Such divorces often delve into the complex world of alternative investments, including venture funds, hedge funds, private equity, private credit, natural resources, digital assets, real estate and limited partnerships holding other non-traditional assets. These assets, by their nature, introduce unique challenges in the valuation and division process, essentially requiring the skill of an Orange County divorce lawyer with specialized expertise.

The Complexity of Alternative Investments in an Orange County Divorce

Alternative investments represent a broad category of investments that are characterized by their complexity, lack of liquidity, and the difficulty in valuing them accurately. Unlike traditional assets, where current market values can readily be determined, alternative investments require a nuanced understanding of their market, the macro economy, the specific conditions affecting their value, and the appropriate methods for valuation.

In an Orange County divorce, the court is required to equally divide the marital estate. This does not necessarily mean a literal 50/50 split of each asset but rather a distribution of the entire estate that is equal. Some assets, particularly alternative investments, may be hard or impossible to legally divide. If they cannot be divided due to the unwillingness of the General Partner, one spouse will be forced to hold the interest of the other spouse “in trust” for that spouse until the partnership is terminated which can be up to 12 years.

Holding the interest in trust presents problems for both spouses. The trustee spouse must comply with ongoing fiduciary duties and the other spouse must rely on the trustee spouse to equally divide distributions, provide documentation like k-1s on a timely basis, etc. An interest may be allocated wholly to one party, with the other receiving offsetting assets or compensation to equalize the division. The compensation must take the form of an equalization payment paid at the time the judgment is entered or over a period of years. An award of one of these assets to one party hinges on the ability to accurately value the assets held in the partnership, a task that can be daunting due to their complex nature and the speculative elements involved in their valuation.

Valuation Challenges

The valuation of alternative investments in a divorce context is fraught with challenges. Many such investments are valued on a “mark to market” basis, which is intended to reflect the current values. However, due to the nature of many alternative investments, the complexity of the valuations and the fact that values may fluctuate wildly, the value may not be the actual value of the assets on the date of the valuation. Moreover, the valuation methodologies used in the investment world, may utilize the discounted cash flow method or other methods that involve speculation about future profits, making them unsuitable for divorce proceedings where speculation is generally not permitted. Generally, valuations in an Orange County divorce, of ongoing business interests apply the excess earnings or the capitalization of excess earning to the business’s financial performance over the prior five years.

Furthermore, the practicality of performing an independent valuation of these assets in a divorce context is often not feasible due to the high costs and expertise required. This can lead to situations where an asset is simply divided equally without a true understanding of its current value. Such an approach may be problematic in a number of situations. For example, when the terms of the partnership require future capital calls and one spouse refuses to pay their share of the capital call when due.

Legal Expertise is the Key

The unique challenges presented by alternative investments in a divorce context underscore the importance of retaining an Orange County divorce lawyer with specialized knowledge in these areas. A lawyer well-versed in high-net-worth divorces and the intricacies of alternative investments can provide invaluable guidance and protection. They can navigate the valuation process, negotiate the terms of settlements that consider the risk, illiquidity and nature of these investments, and address potential future liabilities related to capital calls.

For those going through an Orange County divorce with alternative investments, choosing a lawyer with the right expertise is not just an option—it is a necessity. The right legal counsel can ensure that assets are addressed properly and that your financial interests are protected.

Our Website As A Tool To Help You Find The Right Lawyer

The world of alternative investments is just one area of family law that must be characterized as complex. How does one find the right Orange County divorce lawyer? Our website may be a valuable resource to you in your search to identify the right lawyer for your unique situation. Our team of 20 Orange County divorce lawyers limit their practices to family law matters filed in Orange County. We bring over 350 years of combined experience to our clients’ cases which allows us to leverage a broad wealth of knowledge into creatively achieving our clients’ objectives.

For over four decades, Minyard Morris has provided upper-level professionals high-caliber divorce representation. To discuss your alternative investments with an experienced divorce attorney, call us at 949-724-1111 or send us an email inquiry to schedule a consultation.

Characterization & Allocation of Equity in Real Property

California family law courts allocate the increase in equity in real property during the marriage to the community and/or the separate property of the parties based on a number of factors:

- Changes in title

- Date of acquisition

- Source of funds used for acquisition, improvements and/or principal payments on a loan

- Increase in value

- Refinancing

Can the Community Acquire an Interest in the Separate Property House of One Spouse?

California family law dictates that the community may acquire an interest in real property if community funds are used to make principal payments on a mortgage secured by a residence owned solely by one spouse (IRMO Moore/IRMO Marsden). Payments on an interest only loan do not create a right to reimbursement or an ownership interest in the property.

If community money is used to improve a separate property, there may be a right to reimbursement.

Cohabitation and Financial Liability

Unmarried parties residing together may be impacted by various laws that relate to family law. Cohabiting in a romantic relationship subjects a person to the Domestic Violence Protection Act (DVPA), and cohabitation may create property rights from an explicit or implicit agreement or contract. Rights arising out of cohabiting are based on contract law, not family law.

What is a Cohabitation “Marvin” Case?

Cohabitation can lead to civil litigation in a “Marvin case.” The phrase “Marvin case” refers to an Appellate Court case between Michelle Triola Marvin and Lee Marvin, the actor, where she sought property and support. Michelle did not prevail in her case, but with a different set of facts, one could prevail in certain aspects. A Marvin case is very different than a divorce. A party does not have the benefit of the Family Code in a Marvin Action. These matters are essentially civil matters, and not tried in a divorce court. Attorney fees cannot be collected from the other party. The party seeking relief has the burden of proof on all issues. Like in any civil case, the litigants are entitled to a jury.

Can Cohabitation Result in Parties Being Deemed to be Married?

California does not recognize common law marriage. There is no risk that cohabitation, for any length of time, will create marital property, marital rights, or a marriage itself. No community property is created during cohabitation. Some other states recognize common law marriages that are created by cohabitation for a set number of years.

Community vs Separate Property

Although defining community property and separate property seems very straight forward, often the issues are extraordinarily complex. Separate property, as defined in California, is an asset owned prior to the date of marriage, acquired after the date of separation, or acquired during the marriage by way of inheritance or gift as it is defined by the California Family Law Code. Separate property is not divided between the parties but rather is confirmed to the owning party.

Income, rents and dividends generated by separate property are separate property. Income earned by a party after the date of separation is also separate property.

California law defines community property as an asset acquired after the date of marriage and prior to the date of separation, unless the asset was acquired by way of inheritance or gift as it is defined by statute. The court will divide community property equally in a divorce.

Marital Contributions To Separate Property

The community estate may have a right to reimbursement where the couple used community effort or community funds to benefit the separate property of one party. For example, if one party worked in and grew a separate property business, the community may have a right to reimbursement of a portion of the increase in the value of the business during the marriage.

If your divorce involves complex issues of separate and community property, including business interests, contact one of our experienced divorce attorneys at Minyard Morris. Call our Newport Beach office at 949-724-1111 or contact us online.

Separate Property Tracing

What is Tracing?

Tracing is the process utilized to prove that a party’s separate property was the source of funds used to purchase an asset or make an expenditure that is reimburseable.

When is Tracing Utilized?

Tracing is utilized when separate property and community property are commingled in an account or in an asset.

What are Examples of Commingling?

Commingling occurs when separate property funds and community property funds are deposited into the same account, when separate property funds are used to purchase a jointly titled asset, when separate funds are used to make payments on a mortgage on a community asset or when separate funds are used to improve a community asset.

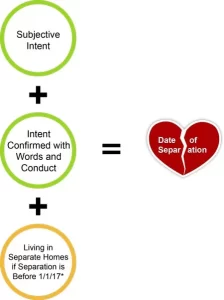

Date of Separation?

The date of separation is essentially the end of the relationship. The length of the marriage is the period between the date of marriage and the date of separation. The date of separation may be relevant to a number of issues in a divorce including the duration of any spousal support. A business may be valued at either the date of separation or at trial. Earnings after separation are separate property, and debts incurred after are separate debts.

Understanding what is required to establish a date of separation may be extremely helpful in avoiding or minimizing litigation costs involving the determination of the date of separation.

Deferred Compensation Plans Valuation & Characterization

What is a Deferred Compensation Plan?

Deferred compensation plans come in many different shapes and sizes. Some of these employment benefits may not be restricted by the rules and regulations of the Employee Retirement Income Security Act (ERISA) and thus can be structured to meet the specific needs and objectives of employees and employers. They may be granted to specific employees without regard to the benefits received by other employees. They are often complex in structure, difficult to value, and may present problematic enforcement issues. These benefits may not ever be received or may be received many years in the future. To the extent that a plan or a portion of a plan is earned during the marriage, that part will be characterized by the divorce court as community property.

What is the Difference Between a Qualified and a Non-Qualified Deferred Compensation Plan?

A qualified deferred compensation plan must comply with all of the rules and regulations of the Employee Retirement Income Security Act (ERISA) and must be offered to all employees. An example of such a plan would be a 401(K) plan. Qualified plans have maximum contribution limits.

A non-qualified plan is not restricted by ERISA, does not have to be offered to all employees, may have a security risk in that there is no guarantee of payment and is unfunded obligations to the business.

Characterization, Division & Allocation of Retirement Plans

California divorce courts may characterize and value retirement plans in a divorce based upon the following factors, depending on the details of each specific plan:

- Type of plan;

- Increase in plan value during the marriage;

- Contributions to the plan during the marriage;

- Specific contractual terms of the plan;

- Performance of plan assets;

- Age of the employee;

- Years of employment before and after the marriage;

- First possible retirement date; and

- Survivorship options

California divorce courts generally allocate retirement plan benefits between separate property and community property according to when the benefits were earned. Benefits “earned” during the marriage (after the date of marriage and before the date of separation) are generally characterized by divorce courts as community property. Benefits “earned” before the date of marriage, or after the date of separation, are generally characterized as separate property. Complications may occur relative to dividing the earnings of the plan assets or when records are missing, when valuing a defined benefit plan.

Characterization, Division & Allocation of Stock Options

In a California divorce, stock options and similar assets granted during the marriage, or partially vested during the marriage, may have a community property component. Stock options that are earned during the marriage are allocated between community property and separate property. The foundation for the allocation is the community property presumption that provides that “earnings” during the marriage are community property.

If a spouse is compensated during the marriage, in part, with a grant of stock options that partially vest during the marriage, the stock options will most likely be partially community property. If a spouse’s employment during the marriage results in partial vesting of stock options granted before the date of the marriage, the options will also most likely have a community property component. The number of options allocated between separate property and community property can vary depending upon which formula is used.

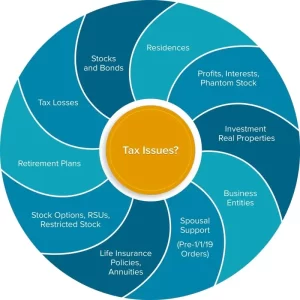

Division of Complex Assets With Tax Issues

Tax issues cannot be ignored. Often tax issues are not identified until it is too late to avoid the consequences, manage them or structure around them. Tax is yet another area of sophistication that must be addressed in a divorce. Tax plays a role in many, if not most, divorce cases. Divorces involve income and assets that frequently have tax related issues.

Tax issues may impact the actual values of many asset categories and they may impact decisions relative to whether an asset is desirable to a party. The tax issues related to the following issues and assets should be analyzed early in the divorce.

Tax rules and regulations must be strictly adhered to in order to avoid additional tax, penalties and interest. The Internal Revenue Code (IRC) is somewhat like a minefield in enemy territory with the distinction being that the IRC provides a map detailing the exact location of the explosives. Unless you are familiar with the IRC and its traps you run the risk of unexpected and costly surprises.

FAQs About Property Division Law in Orange County,CA

What Are Some Signs My Spouse Is Hiding Assets?

Hiding assets in a California divorce is not only unethical, it is taken seriously by the courts and can come with extreme penalties. If you believe your spouse is hiding assets, it is essential that you speak to an attorney. Common signs an individual might be hiding assets in a divorce can include sudden changes in their financial behavior, such as withdrawing large amounts from shared accounts and transferring certain assets to their family members or friends without reason.

Reasons to Hire a Property Division Lawyer in a California Divorce?

While hiring an attorney is not required in a California divorce, they can prove vital to the outcome of your case. It is important to retain the services of an attorney for many reasons, including if you and your spouse share a large amount of debt or are even facing bankruptcy, you disagree about what to do with a home or business owned in the marriage, or if you or your spouse own a pension plan.

What Is Excluded From Community Property in California?

There are several pieces of property that may be excluded from the community property rules of California. These can include any gifts or inheritances received by one spouse before or during the marriage or any forms of property or debt that were acquired by a single spouse before the marriage was legalized. This can include anything from vehicles to jewelry to collectible items.

What Will a Divorce Lawyer Charge in California?

It can be challenging to calculate the exact amount a divorce lawyer might charge to represent your case in the state of California. This is due to the fact that there are several factors involved in these proceedings that can influence the final costs of hiring an attorney. These factors can include the overall complexity and duration of your divorce case and the experience of your attorney.

Strategic Property Division Representation

At Minyard Morris , we work with clients to protect their assets. Our 20 Orange County divorce lawyers handle cases from the more traditional divorce to the complex, high net worth divorce. Call 949-724-1111 or connect with us through email.