Frequently Asked Questions Regarding Family Law Matters

Our FAQ section offers detailed information about a full range of important questions that affect divorce cases. The responses address key subjects including business valuation, child custody, spousal support, modification of orders and more. Click on the dropdown menu for a full list of topics, then choose the specific questions applicable to your situation.

×

Are Parties Required to Voluntarily Provide Each Other with All Material Information About the Assets and Debts?

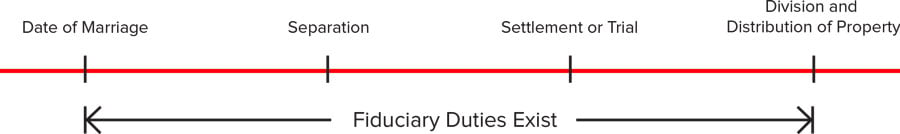

Parties to a divorce have fiduciary duties to one another. Fiduciary duties are wide ranging, but include the duty to voluntarily share information and documents, and to voluntarily share material facts and information related to community assets, separate assets, debts, investment opportunities, and amounts, and sources of income with the other party (IRMO Feldman). The duties continue until the divorce is finalized, and the property is divided. A breach of fiduciary duties can result in substantial financial sanctions, a 100% penalty equal to the value of the undisclosed asset, and/or attorney fees.

What Does It Mean to Breach a Fiduciary Duty to a Spouse?

Parties to a divorce have fiduciary duties to one another. Fiduciary duties are wide ranging but include the duty to voluntarily share information and documents and to voluntarily share material facts and information relative to community assets, separate assets, debts, investment opportunities, and amounts and sources of income with the other party (IRMO Feldman). The duties continue until the divorce is finalized and the property is divided. A breach of fiduciary duties can result in substantial financial sanctions, a 100% penalty equal to the value of the undisclosed asset, and/or attorney fees.

What Are Examples of a Breach of a Fiduciary Duty?

An undisclosed and unauthorized transfer of community property to a separate investment account that results in a loss of community property is a breach of fiduciary duty and warrants a financial sanction (IRMO Kamgar).

A speculative and unauthorized loan of money by a party after the date of separation may be a breach of the fiduciary duty that may result in a financial sanction (IRMO Quay).

A breach of fiduciary duty does not occur because one party receives a huge windfall relative to an asset they are awarded in the divorce, unless there has been a fraud, misrepresentation, concealment, or a failure to provide the relevant material facts and information (IRMO Georgiou & Leslie).

Are There Any Situations Where a Party Is Not Required to Serve the Other Party the Final Declaration of Disclosure?

Although a party is required to serve the other with the final declaration of disclosure, this rule may not be required if the judgment or agreement is executed before the petition for divorce is filed with the court (IRMO Evans).

Even if a final declaration of disclosure is not required, or is waived, the same fiduciary duty disclosures of material facts and information exists.

Does Representing a Party in a Divorce That Involves the Valuation of a Business Require Specialized Skills and Training?

The State Bar of California recognizes Family Law as a specialized practice area. Representing clients in divorce matters that involve the valuation of business interests is even more specialized. Handling these matters requires a working knowledge of valuation principles, taxation, compensation issues, accounting principles, general foundational business knowledge, the complex and conflicting divorce valuation statutes, relevant case law and divorce litigation skills.

Is It Always Necessary to Hire a Valuation Expert if There is an Issue Relative to the Valuation of a Business in a Divorce?

The potential Family Law Team

Experts

Representing clients in divorce matters involving a business interest usually requires the retention of a number of experts, including a valuation expert, who assists in the negotiations and in reaching a settlement. In many cases, the divorce court will order the accountants to meet and confer long before the divorce trial to attempt to resolve or narrow their differences.

What Role Does a Valuation Expert Play in a Divorce?

The expertise and competence of an expert will often have a significant impact on final settlement or trial results. The importance of the role played by an expert in a divorce cannot be over-emphasized. In some divorces, the value of an expert can exceed that of the divorce lawyer. Experts should be retained at the commencement of a divorce, and not after a potential settlement has fallen apart. The expert’s input should be sought before any offers are made or responded to. Early retention of a divorce valuation expert can be critical in the crafting and development of settlement offers, case strategy, and the game plan.

As with Orange County divorce lawyers, all valuation experts are not created equal. It is difficult to quantify the value of the right experts in a divorce. The reputation of an expert is critical to the weight given to an expert by the judge. An unqualified expert may not qualify as an expert in a divorce trial, which would prevent them from testifying. Such a result could be devastating to the outcome of the divorce, as the lawyer would not be able to present evidence of the valuation of the business interest to the divorce court.

Can You Use Your Personal Accountant in the Divorce to Value Your Business?

It is not prudent to attempt to utilize your personal accountant to perform the valuation, even if they are experienced and qualified in the field of family law valuation. It is essential that the expert knows the divorce valuation nuances, as opposed to general valuation principles. It is also critical for the expert to have credibility with the divorce courts and be seen as unbiased and objective by the judge.

What Measure of Value Does a Family Law Court Use in Valuing a Business?

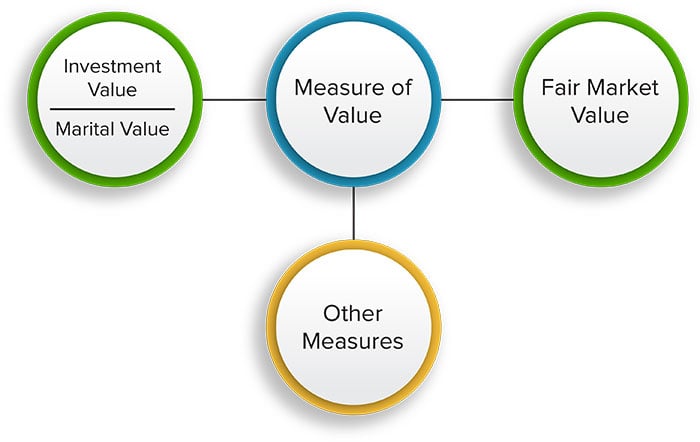

Measure of Value

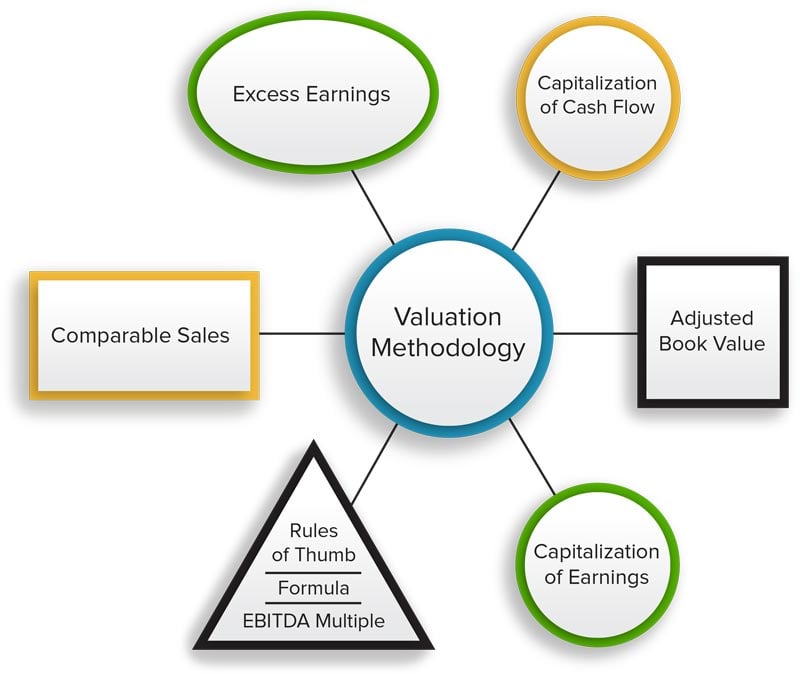

Methods of Valuation

The measure of value can also be a significant issue in a divorce. The divorce court may use going concern value or investment value. The basis for a divorce court using investment value is based on the idea that the business is not being sold, and the value is that of an investment held by the owner himself (IRMO Hewitson). In other words, what is the value of the business to the operator-spouse.

What Formula or Methodology is Used by a Family Law Court to Value a Business?

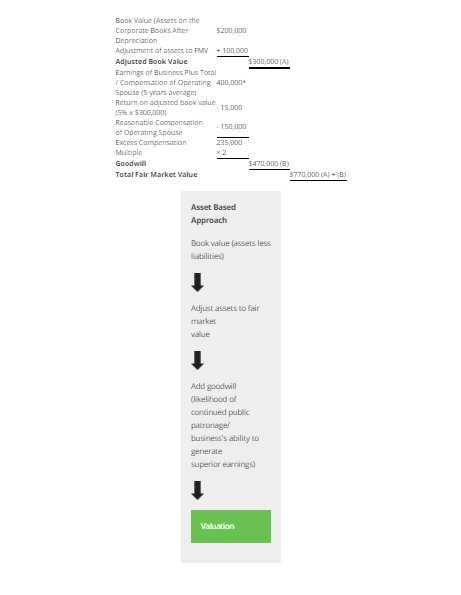

Valuation Method: Capitalization of Excess Earnings (Asset Based Approach)

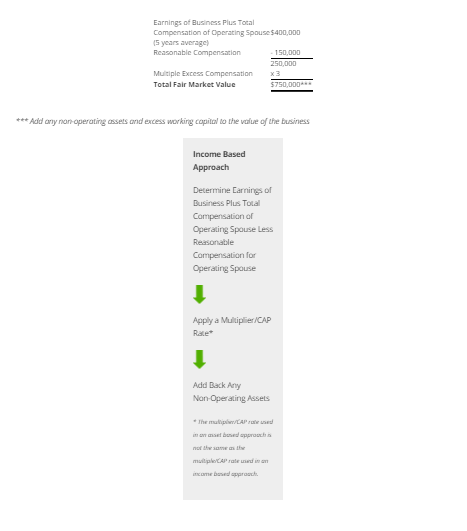

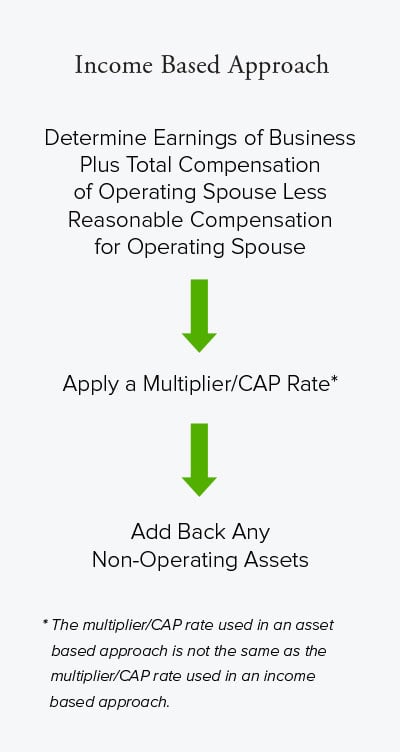

Valuation Method: Capitalization of Earnings (Income Based Approach)

The value may be determined by a number of different formulas, so long as they do not involve speculation, and don’t violate any family law principles. Capitalization of earnings, and capitalization of excess earnings, are the two approaches most often used in Orange County family law matters. A divorce court may also use the market approach for valuation, but the use of this approach presents a number of very significant challenges, including using truly comparable companies for comparison. Rules of thumb approaches are generally not accepted by the Orange County divorce courts, because it is difficult to prove the underlying basis for the rule of thumb formulas (IRMO Honer and IRMO Hewitson). Valuations in Orange County family law cases are quite different than business valuations for other purposes.

A divorce court may also consider prior sales or purchases of interests in the business being valued. This approach can have its own problems, including, that prior sale may utilize the discounted future cash flow method.

In family law, a business cannot be valued using the operating-spouses’ expected future earnings (IRMO Fortier). The widely recognized valuation method referred to as the ‘discounted future cash flow’ method (DCF) is not used in California divorces. The divorce court cannot value a business based on speculation relative to the business’s future success or failure.

Generally, a valuation in a divorce requires an analysis of the business’s financial performance during the past five years. An expert may omit from the average, years or events if they are non-recurring, and if the omission will result in a more accurate view of the normalized financial performance of the business. The five year average may be weighted, depending on the facts and the trends.

How is Goodwill Defined in a Divorce?

Goodwill is defined as the expectation of future patronage. In other words, goodwill is defined as the likelihood that the business will continue to attract customers.

The value of a business is a combination of the net value of the assets of the business (assets minus liabilities) plus the value of goodwill.

Goodwill cannot be based on post-marital efforts of a spouse (IRMO Foster). Goodwill must be calculated using the historical financial performance of a business over a representative period of time, which is generally five years (IRMO Rosen and IRMO Aufmuth).

It is not fair to say that all businesses have goodwill, but goodwill must be addressed and allocated on the marital balance if it exists (IRMO Golden). Business goodwill must be valued and allocated, but at least one repeated case says that individuals do not have goodwill (IRMO McTiernan and Dubrow). A licensed financial advisor’s client list has a value akin to goodwill (IRMO Finby). The divorce court may average valuation methods in arriving at the value of a business (IRMO Webb). Publicly traded companies are valued differently than privately held companies, and divorce courts are not allowed to use publicly traded price earnings ratio in valuing a privately held company (IRMO Lotz).

The terms of a partnership agreement may limit the community’s interest in entity goodwill, under certain circumstances (IRMO Iredale and Cates).

The divorce court may make a non-competition order to protect a spouse’s value in the business that they is buying from the community in a divorce (IRMO Greaux and Mermin).

A potential speculative non-competition agreement cannot be considered in the valuation of a business (IRMO Czapar). A business valuation cannot be adjusted by the hypothetical value of a potential future employment contact (IRMO Duncan).

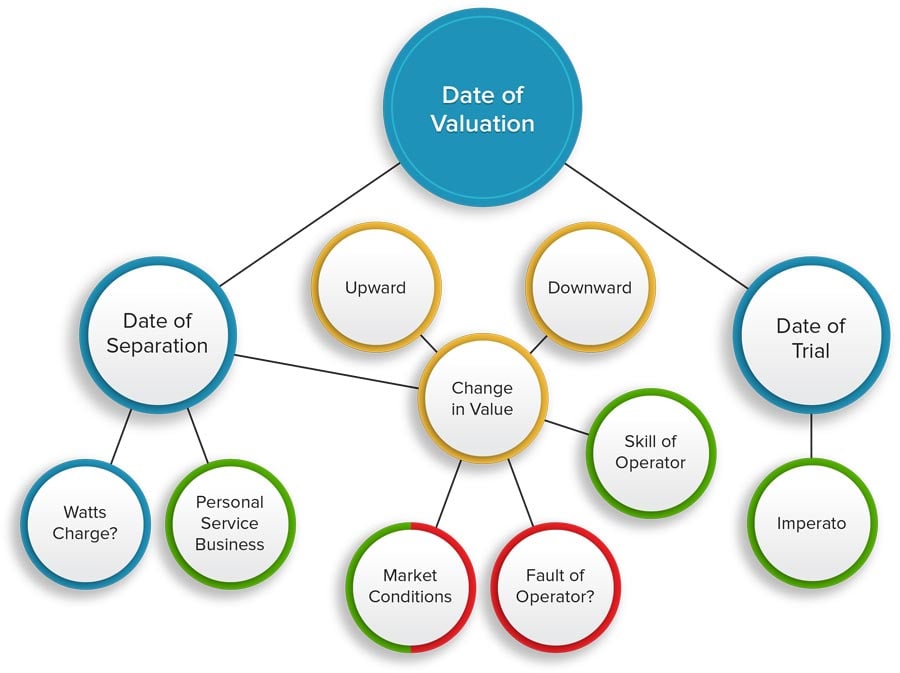

Is a Business Valued on the Date of Separation?

Date of Valuation

Impacted Issues

The valuation date of a business in a divorce can have a very significant impact on the valuation itself. There is a specific family code section and extensive case law that address the valuation date but generally a business is valued as close to the date of settlement or trial as is reasonably practical. Of course, there are exceptions to this rule. Under some circumstances, a business may be valued on the date of separation. There are, also very specific rules relative to being allowed to present evidence in trial of a valuation date other than the date of trial (IRMO Green, IRMO Duncan and IRMO Stevenson).

Do the Assets of a Business Need to be Valued by an Expert?

It is generally necessary to value the assets of a business. For example, if the business owns real estate, machinery, computers, intellectual property or other tangible or intangible property, experts may be needed to value these assets in that, typically, the valuation expert is not qualified to value the capital assets of the business. Depending on which valuation method is being used, the valuation may also need to address operating vs. non-operating assets. Which are assets that are not needed for the continued performance of the business.

How is Controllable Cash Flow Determined?

Compensation

In family law matters, valuation experts render opinions as to the operating-spouse’s total controllable cash flow. Determining cash flow is not simply looking at the income or tax returns of the operating-spouse.

Income generally does not equal cash flow. A business may recognize significant income but have little or no cash flow in a particular year. On the other hand, a business may make substantial distributions in a year and have little or no income.

The amount of the controllable cash flow can be a significant source of conflict between the experts. Cash flow can be based on the income approach or the distribution approach. Cash flow generally includes the compensation of the operating-spouse, various perks and in certain situations the profits of the business. In divorces there can be an issue as to what portion of the profits could be distributed to the owner without adversely impacting the business operations which relates to the working capital needs of the business. Obviously, profits should not be added to cash flow if it would jeopardize the business’s ability to remain current on its debts and remain solvent.

Economic depreciation (vs. non-economic depreciation) should generally be added back to cash flow.

How is Reasonable Compensation Determined?

Compensation

There are two distinct approaches to determining the reasonable compensation of the operating-spouse. Differences of opinion in this area can lead to very significant differences in the values assigned to goodwill. One approach looks to the annual salary of a typical salaried employee who has similar experience to that of the owner-spouse. The other approach looks to the ‘similarly situated professional’ which is an approach that was addressed in the Orange County divorce case IRMO Ackerman. Using this approach, the divorce court looks at the cost of hiring a non-owner outsider to perform the exact duties as does the owner-spouse. This approach would assume that the individual had the same skill set, same contacts, same work ethic, etc. as the owner-operator. This approach generates a lower goodwill value than does the other approach.

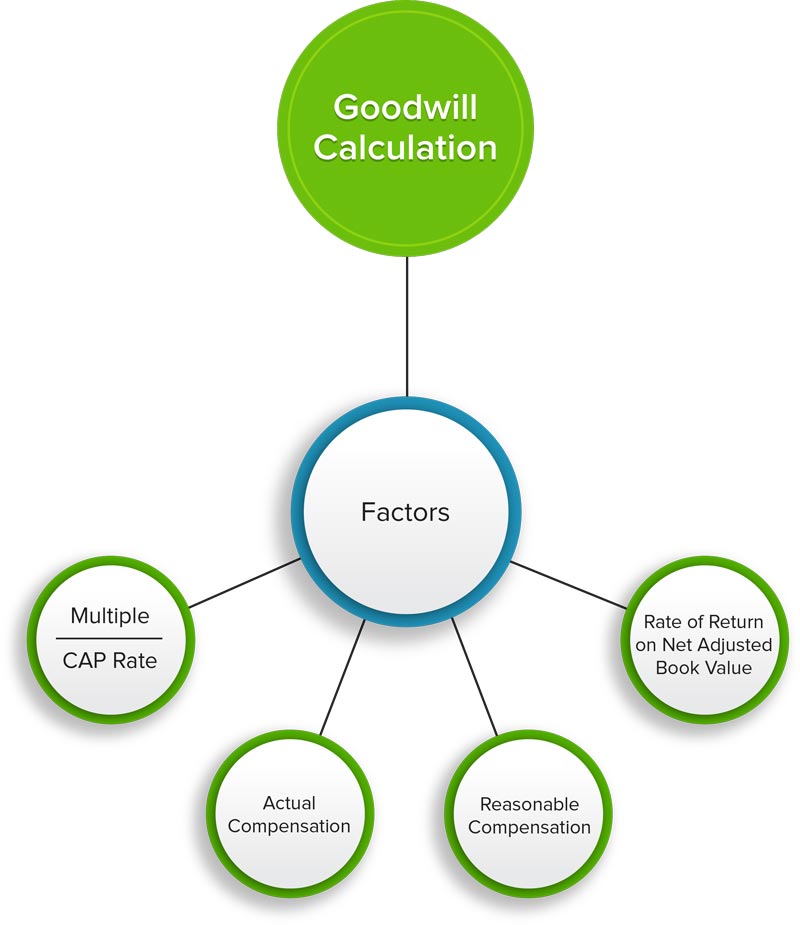

Do Opposing Experts Generally Agree on the Value of Goodwill?

Often times, the opinions of opposing experts are relatively close regarding the adjusted book value of a business but they rarely agree on the value of goodwill. The specific issues that experts generally disagree on are:

- Controllable cash flow;

- Reasonable compensation; and

- Multiplier/CAP rate

How Does a Rate of Return on Tangible Assets Impact the Valuation Methodology?

Calculating a rate of return on tangible assets is a component of the capitalization of excess earnings valuation method. The rate of return varies depending on the expert, the general economic conditions and prevailing interest rates. The rate can be described as the “industry rate,” the “rate of return” that one would expect to earn on the specific assets utilized in the type of business in question or the rate that the owner would have to pay to borrow money at his or her bank. The rate of return is multiplied by the value of the tangible assets and the resulting sum represents the portion of the total earnings of the business attributable to the tangible assets. The remaining portion of the earnings are then theoretically generated by the goodwill of the business itself.

| Total Earnings of Business |

$$$$$$ |

| Industry Rate of Return x Tangible Assets |

< $ > |

| Reasonable Compensation of Owner-Operator |

< $$ > |

| Excess Earnings of Business |

$$$ |

Multiplier / Capitalization Rate Conversion Table

| Multiplier | Capitalization Rate |

| 1 | 1.00 |

| 2 | .50 |

| 3 | .333 |

| 4 | .25 |

| 5 | .20 |

What is a "Multiplier" or "Cap Rate?"

If a capitalization approach is utilized, the excess earnings are multiplied by a ‘multiplier’ or divided by the capitalization rate.

The multiplier/capitalization rate relates directly to the risk of the investment. The riskier the business/industry the lower the multiplier. Consider the case of two businesses, one risky and one secure, each with $50,000 of excess earnings. An investor may only be willing to pay one times earning for the goodwill of the riskier business ($50,000) because the business is less likely to continually return the excess earnings to the investor. Alternatively, an investor may be willing to pay three times earnings for the goodwill of the more secure business ($150,000), because the business is more likely to return those excess earnings to the buyer for an extended period.

Other Factors

As in valuations that are performed in other contexts, collectability of accounts receivable, barriers to entry, management team depth, pending legislation, toxic waste, new competitors, minority discounts, bank covenants and many other issues may be relevant.

Is a Family Law Court Bound by the Terms of a Shareholder Agreement Relative to the Value of a Business in a Divorce?

In determining the value of a business in a divorce, the court may consider the value of a business that was agreed to in a partnership agreement, but are not bound to value the business interest using that value. The value set forth in such an agreement is not controlling on the divorce court (IRMO Slater).

There are a number of issues that a divorce court looks to in resolving this issue. If a spousal consent was executed, the court will determine whether the agreement was executed by the non-operating spouse with the knowledge that the value being agreed to, would establish a value for the business interest in a future divorce. Whether the non-operating spouse was represented by a lawyer at the time of the execution of the agreement can be critical in the analysis. The terms of the agreement may be binding on the partners/shareholders, but not be binding on the non-operating spouse.

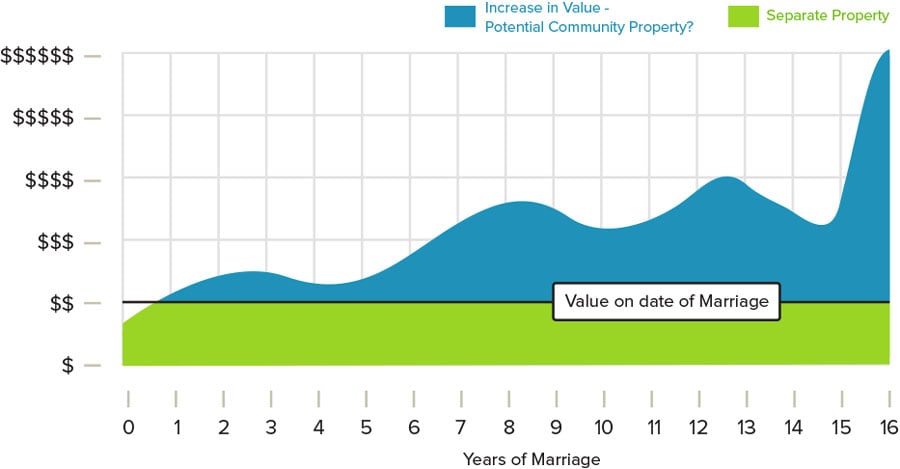

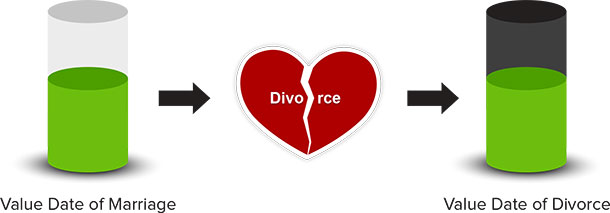

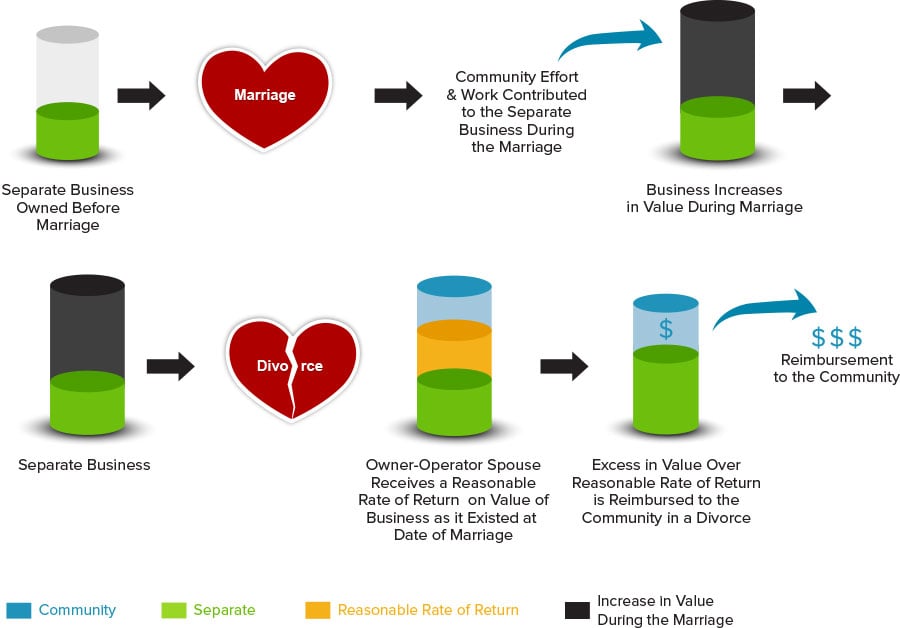

Is the Community Entitled to Reimbursement of a Portion of the Increase in the Value of a Separate Property Business?

There is a presumption that an asset acquired during the marriage is community property. This idea generally applies to the acquisition of a business. However, if a business is acquired prior to the date of the marriage it is the separate property of the owner-spouse.

If the business increases in value during the marriage, the community may be entitled to reimbursement of a portion of that increase. It is clear that the rents, issues, and profits of a separate property asset are the separate property of the owner-spouse. The natural improvement of separate property during the marriage retains its separate property status (IRMO Ney). A change in the form of a business (sole proprietorship to a corporation) does not cause a business to lose its separate property status (IRMO Koester). But, if the increase in value is due, in part, to the effort of a spouse, the community may need reimbursement from the business.

Any reimbursement to the community is based upon the equitable principle that a separate property business is required to repay the community for any uncompensated community effort expended on the separate property business during the marriage. Reimbursement is determined by using one of several different theories or approaches.

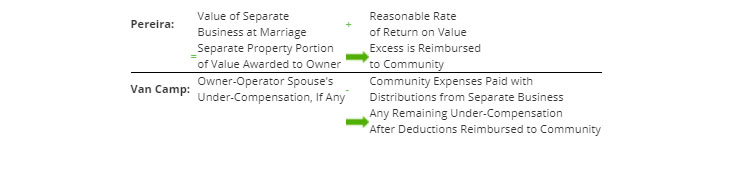

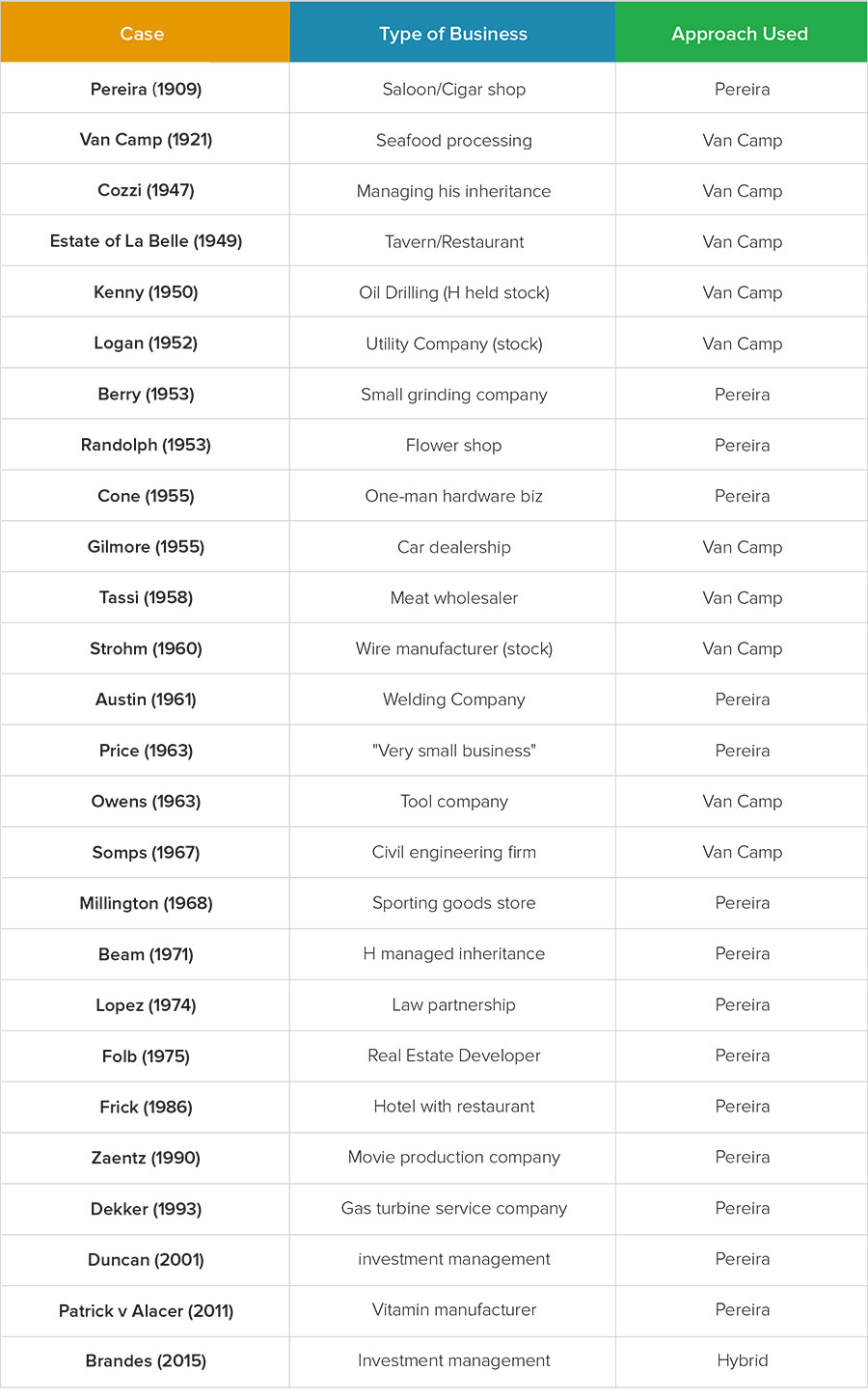

What is the Pereira Approach?

Equitable Allocation Approach

One of the theories, Pereira (IRMO Pereira), assigns to the separate property business a reasonable rate of return on the value of the business as it existed on the date of the marriage, and credits the community with the remaining portion of the increase in value. For example, under Pereira, if a business was valued at $1,000,000 on the date of the marriage, and was valued at $2,000,000 ten years later, the community would need to be reimbursed $1,000,000 minus the interest on $1,000,000 for the ten years. Under this approach, there may exist a conflict over what interest rate is applied to the value of the separate property business between the date of marriage and the date of separation, and whether the interest is simple or compound.

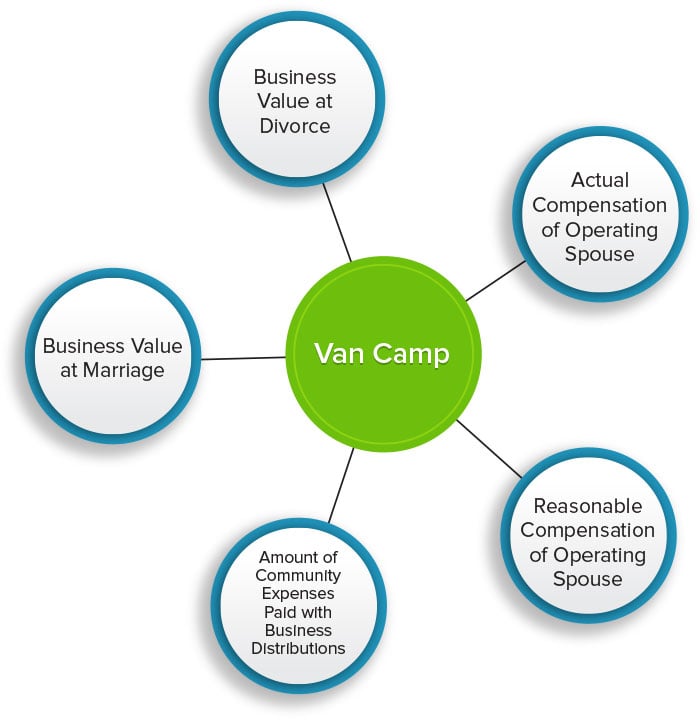

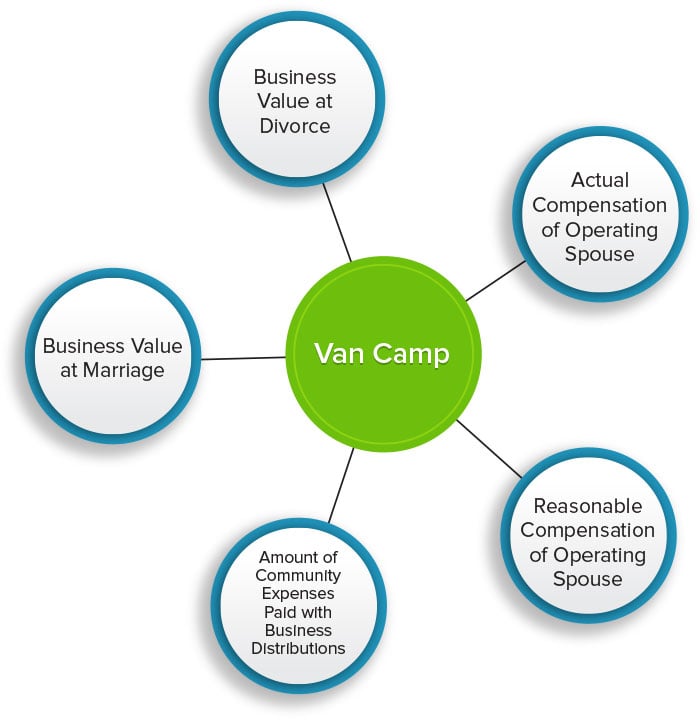

What is the Van Camp Approach?

Another approach, Van Camp (IRMO Van Camp), gives the community a right to reimbursement equal to any under-compensation of the owner-spouse during the marriage, and assigns the remainder of any increase in value to the separate property of the owner-spouse.

Any sums paid, during the marriage, by the separate property business to or for the benefit of the community may be deducted from the reimbursement owed by the separate property business to the community for under-compensation under the Van Camp approach. For example, if the separate property business had contributed $1,000,000 to the community during the marriage, over and above the sums paid to the operator-spouse as compensation, and the amount of under-compensation was $1,100,000, the separate property business would be required to reimburse the community $100,000.

The amount owed to the community under either theory is a right to reimbursement and not an interest in the business itself (Patrick v. Alacer Corp. (Patrick I) and Patrick v. Alacer Corp. (Patrick II)).

Application of either of these theories requires a determination of the value of the business on the date of marriage, and on the date of separation.

Can the Court Use Other Approaches or Theories to Equitably Apportion, Between Separate Property and Community Property, Any Increase in Value of a Separate Property Business?

The family law court may use one theory during a portion of the marriage, and another theory during a different portion of the marriage (IRMO Brandes). The family law court may also use a compromise formula (Todd v. C.I.R.).

Generally, if a separate property company increases in value during the marriage, and the increase is not due primarily to the effort of the owner-spouse, the community is only entitled to reasonable compensation for the work performed by the owner-spouse.

Can a Court Tax Impact the Accounts Receivable?

Should the excess earnings and/or accounts receivable be tax impacted? The impact can be significant to business valuation. Tax impacting relates to attempting to compare apples to apples when valuing C-corporations and S-corporations which are taxed differently. A C-corporation pays tax, while the profits of an S-corporation pays no tax and passes the income on to the owners, who pay the tax. The multiplier and the income stream should both be pre-tax or both be after-tax.

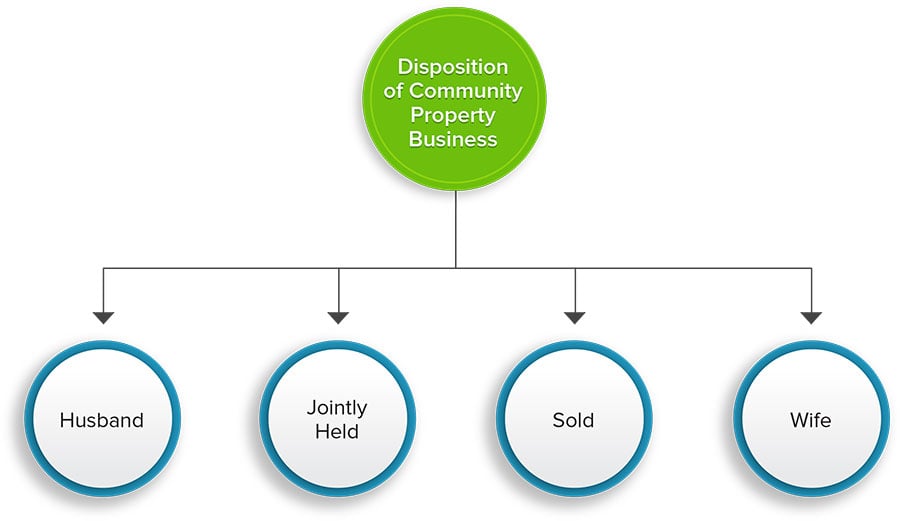

How is a Business Generally Disposed of in a Divorce?

Disposition of the Business

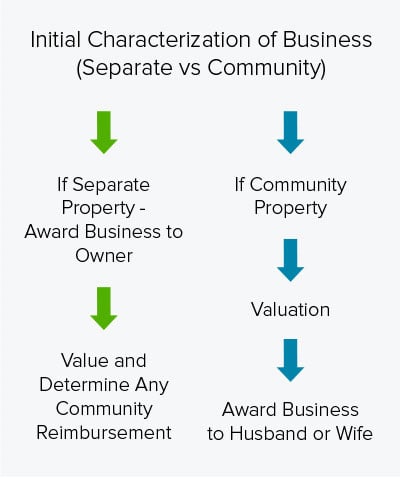

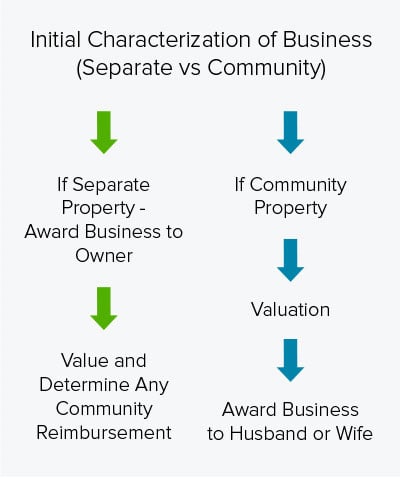

Initial Characterization of Business

It is rare that a business is sold as a result of the divorce. Unless there are very unique circumstances, a business is awarded to the operating-spouse. If the parties operate a business together and both seek an award of the business, it is generally awarded to the party that is most critical to its continued success. It would be rare for a divorce judge to award a business jointly to the parties. Continued joint ownership would most likely occur only if the parties were to agree.

On occassion, the operating-spouse of the business opposes having the business awarded to him. Rarely does a court order a business sold and even more rarely is a business awarded to the non-operating spouse. The operating-spouse often believes that there would be no business without him or her and he or she may be correct. However, to joint ownership in a divorce, that fact is not a determinative factor in the award of a business or the value of the business. Generally, the operating-spouse does not have the option to ‘shut down’ the business without the likelihood of being charged with the value of business as it existed before its closure.

A court may award a business to a party who opposes receiving the business as a part of his or her share of the community property (IRMO Rives).

Do All Divorces with Complex Issues End Up in Trial?

A divorce may involve little to no community property, and cases of this type may be resolved very quickly, inexpensively, and possibly without the services of a divorce lawyer. Other times a divorce may involve extremely complex issues that practically require the involvement of a divorce lawyer and other experts. Cases of this type often resemble business litigation between partners. However, complexity itself does not mean that the matter will involve a trial. Many complex matters are resolved amiably, without the involvement of a judge or a trial.

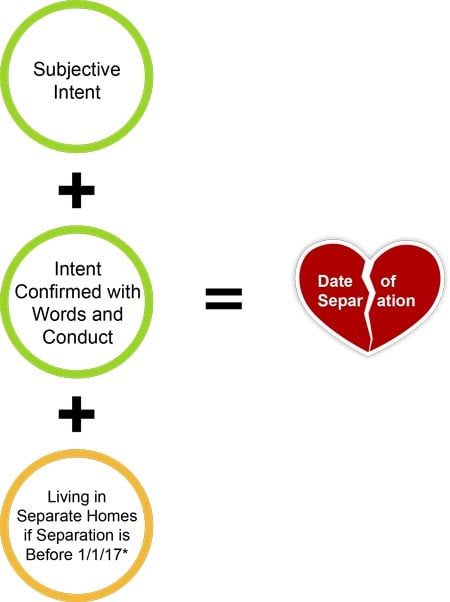

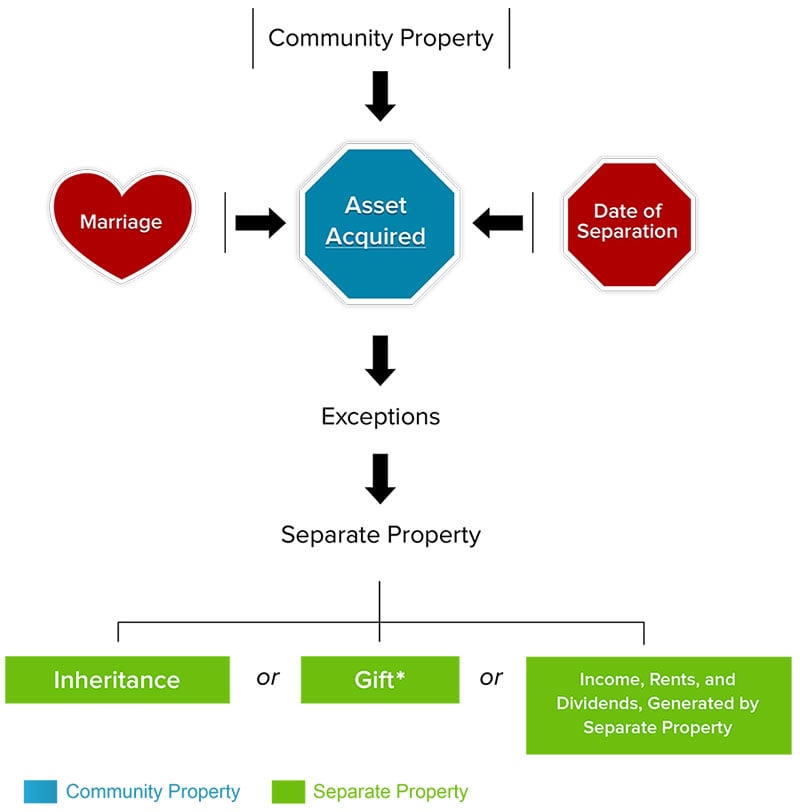

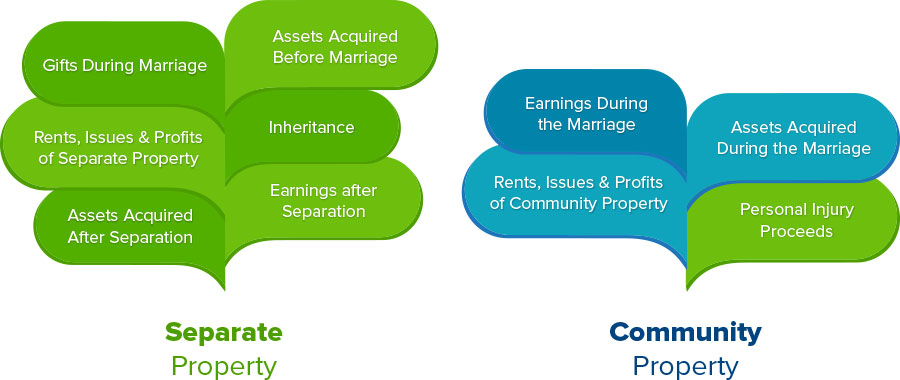

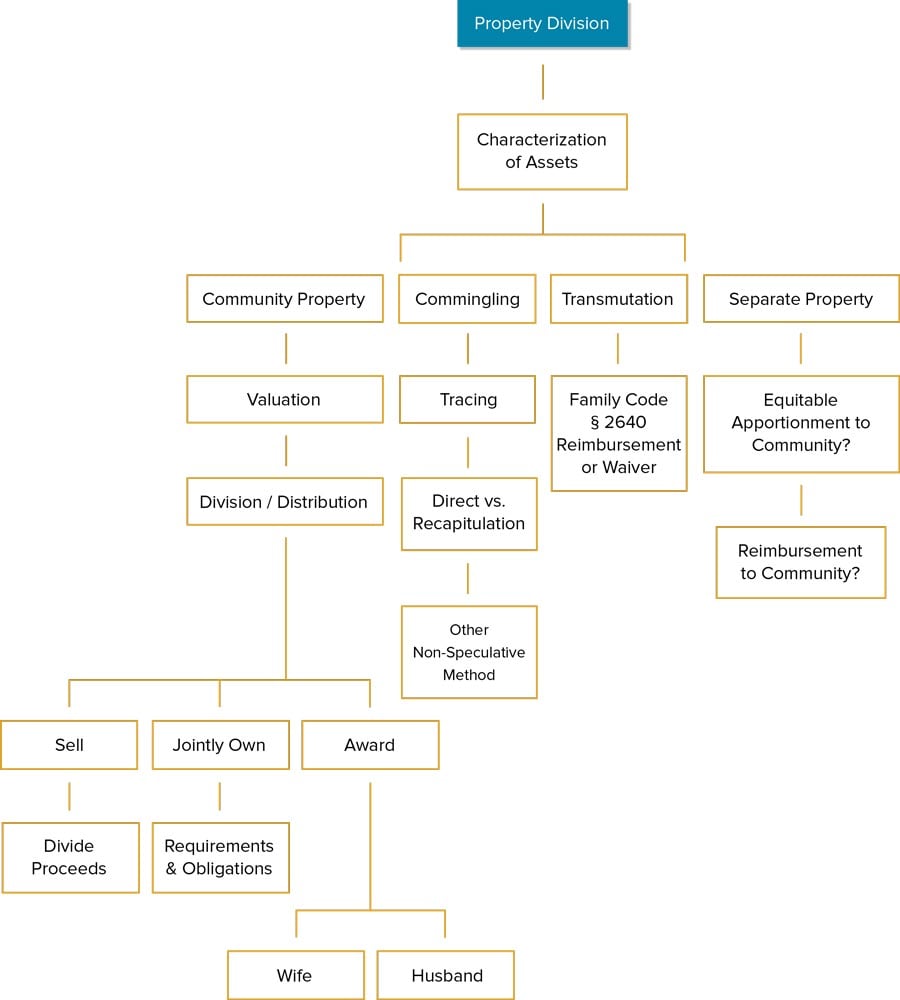

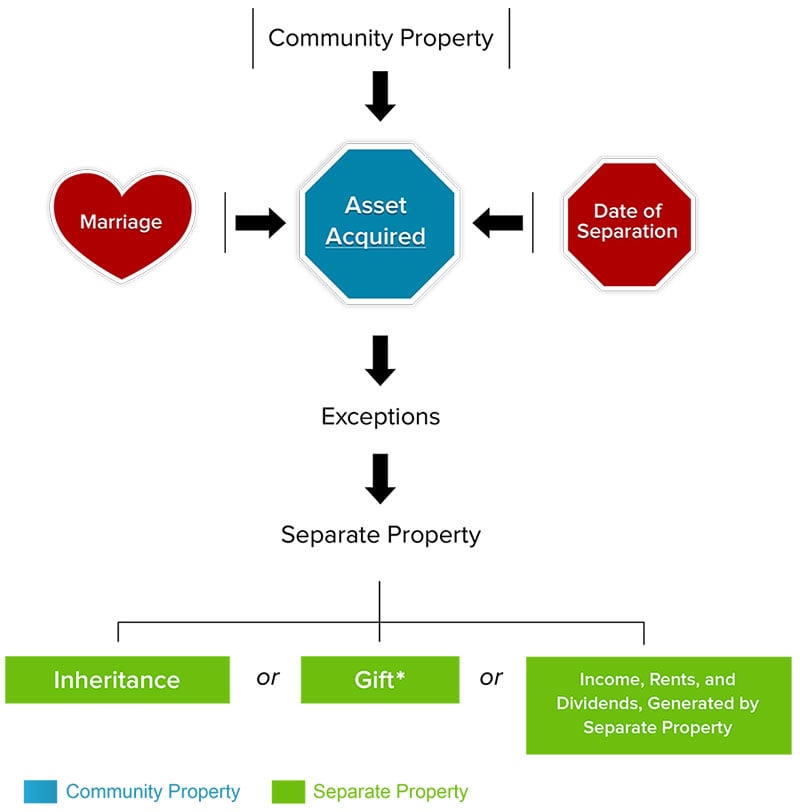

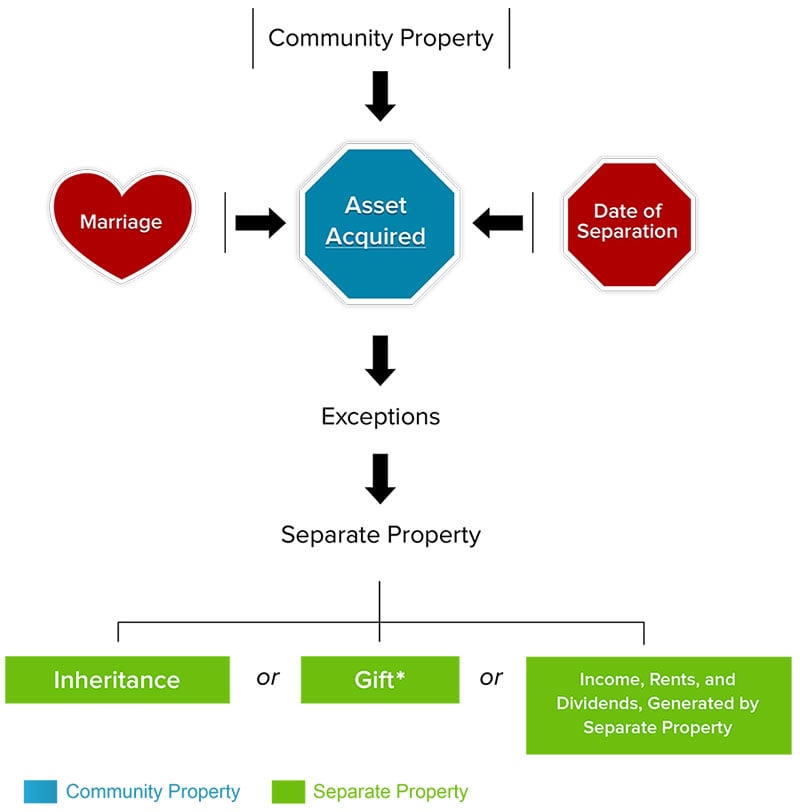

What is Separate Property?

Community Property

Separate Property

Although defining community property and separate property seems very straight forward, often the issues are extraordinarily complex. Separate property, as defined in California, is an asset owned prior to the date of marriage, acquired after the date of separation, or acquired after the date of marriage and prior to the date of separation by way of inheritance or gift as it is defined by the California Family Law Code. Community property is defined as an asset acquired after the date of marriage and prior to the date of separation, unless the asset was acquired by way of inheritance or gift as it is defined by California law. Income, rents, and dividends generated by separate property are separate property.

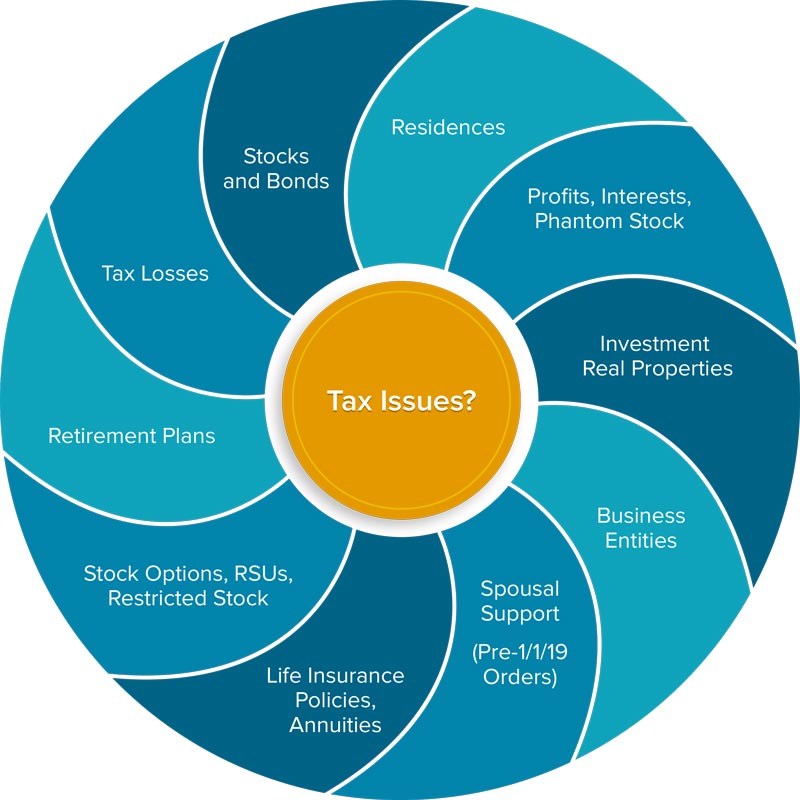

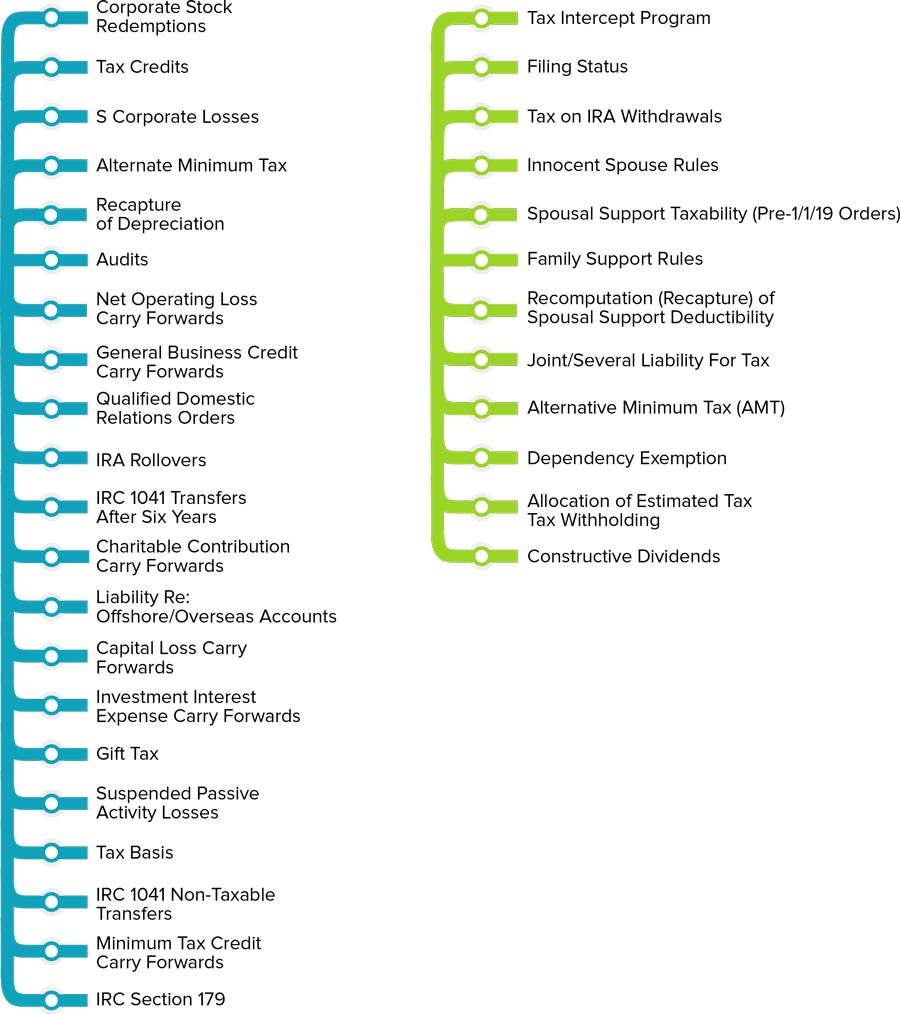

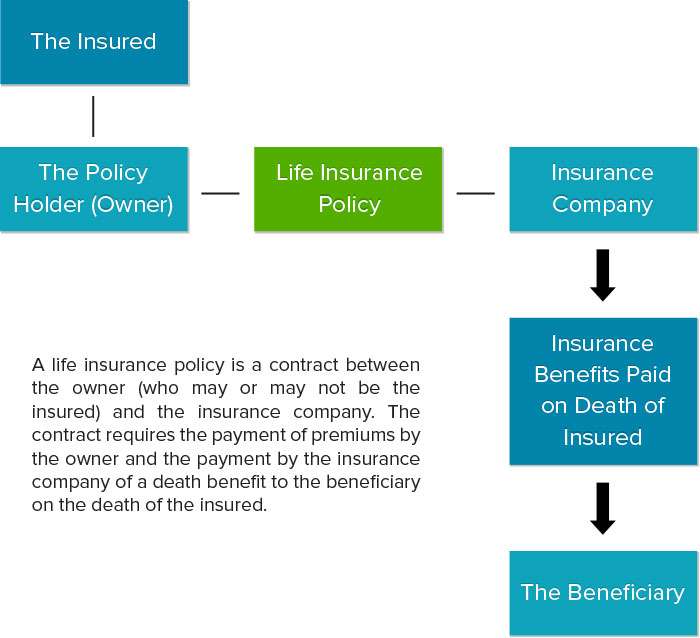

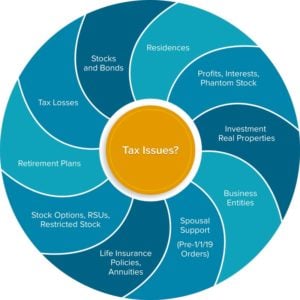

Is Tax Relevant to a Divorce Case?

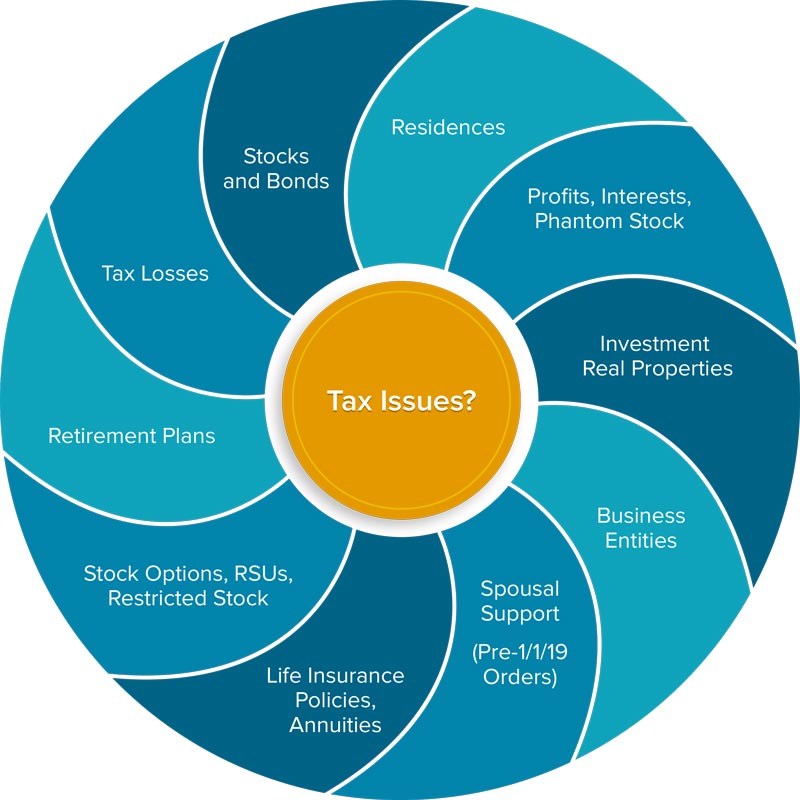

Tax Issues

Tax Issues in Family Law

Tax issues cannot be ignored. Often, tax issues are not identified until it is too late to manage or structure around them. Tax is yet another area of sophistication that must be addressed in a divorce. Tax plays a role in many, if not most, divorce cases. Divorces involve income and assets that frequently have tax related issues.

Tax issues may impact the actual values of many asset categories and decisions as to whether an asset is desirable to a party. The following issues and assets should be analyzed early in the divorce.

Tax rules and regulations must be strictly adhered to in order to avoid additional tax, penalties, and interest. The Internal Revenue Code (IRC) is a minefield in enemy territory, but the IRC provides a map detailing the exact location of the explosives. Unless you are familiar with the IRC, you run the risk of unexpected and costly surprises.

Can a Family Law Court Deduct Embedded Taxes in an Asset When Dividing Community Property?

Embedded capital gains tax relative to an asset are not deducted from the fair market value of the asset in a divorce. The deduction of the tax from the value of an asset in a divorce is limited to situations where the tax is immediate, specific, and arising out of the divorce itself. If an asset is being awarded to a party in a divorce, and that asset is not being sold pursuant to the divorce judgment, there is no deduction from fair market value relative to the tax. Speculative, future tax consequences are irrelevant to the valuation of assets, if the value is determined by the divorce court in a trial. The one exception is tax related to stock options. This exception is due relates to the fact that stock options have no intrinsic value unless and until they are exercised, as opposed to other assets whose value is not dependent on a sale. There is also an issue as to whether the divorce court should tax impact earnings in the valuation of a business.

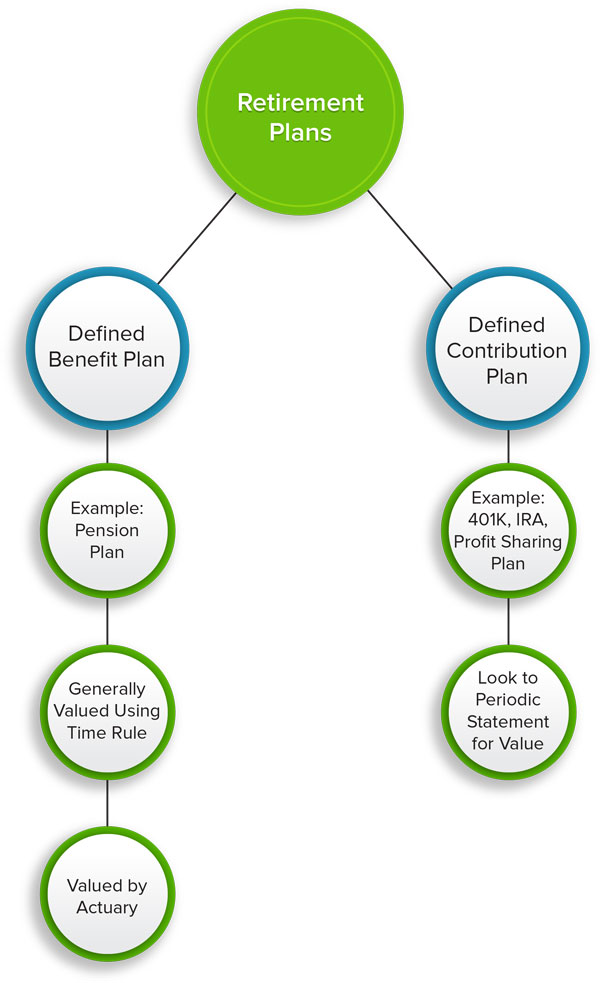

What Factors Do the Courts Analyze in Characterizing and Valuing Retirement Plans?

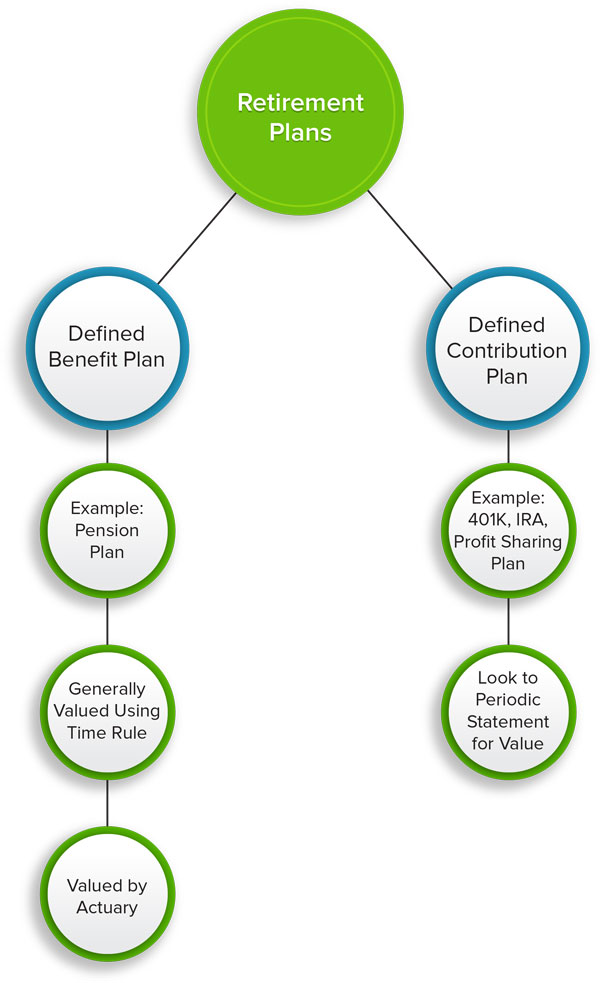

Two Basic Types of Retirement Plans

California divorce courts characterize and value retirement plans in a divorce based upon these and other factors depending on the details of each specific plan:

- Type of plan;

- Increase in plan value during the marriage;

- Contributions to the plan during the marriage;

- Specific contractual terms of the plan;

- Performance of plan assets;

- Age of the employee;

- Years of employment before and after the marriage;

- First possible retirement date; and

- Survivorship options

California divorce courts generally allocate retirement plan benefits between separate property and community property according to when the benefits were earned. Benefits “earned” during the marriage (after the date of marriage and before the date of separation) are generally characterized by divorce courts as community property. Benefits “earned” before the date of marriage or after the date of separation are generally characterized as separate property. Complications may occur relative to dividing the earnings of the plan assets, when records are missing, when valuing a defined benefit plan and when drafting a Qualified Domestic Relations Order.

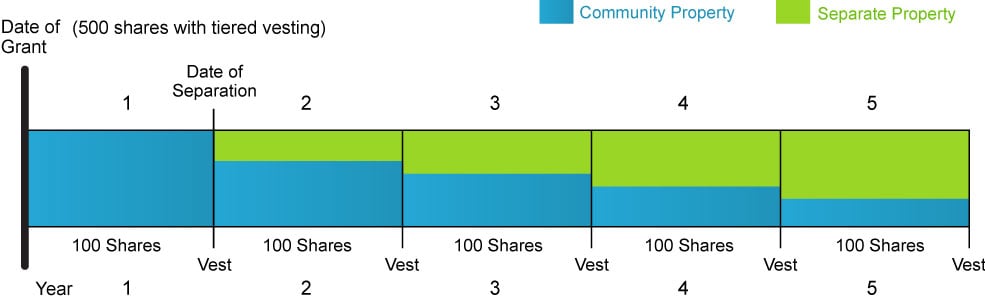

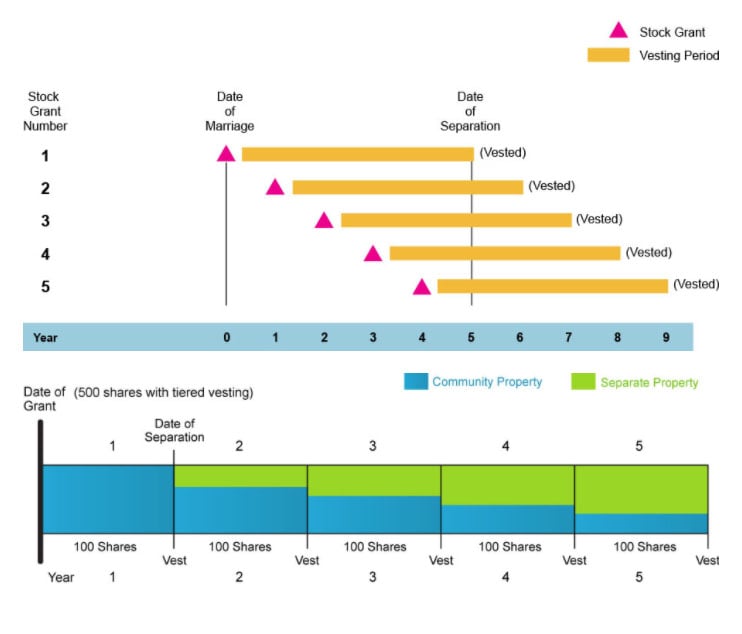

How Are Stock Options Divided?

Cliff Vesting

In a California divorce, stock options and similar assets granted during the marriage and/or partially vested during the marriage may have a community property component. Stock options that are earned partially during the marriage are allocated between community property and separate property. The foundation for the allocation is the community property presumption that provides that “earnings” during the marriage are community property. If a spouse is compensated during the marriage, in part, with a grant of stock options that partially vest during the marriage, the stock options will most likely be partially community property. If a spouse’s employment during the marriage results in partial vesting of stock options granted before the date of the marriage, the options will also most likely have a community property component. The number of options allocated between separate property and community property can vary depending upon which formula is used.

What Factors Does a Family Law Court Analyze in Determining the Characterization of Equity and Reimbursements Relative to Real Property?

Real Property Issues and Factors

California family law courts allocate the increase in equity in real property during the marriage to the community and/or the separate property of the parties based on a number of factors:

- Changes in title

- Date of acquisition

- Source of funds used for acquisition, improvements and/or principal payments on a loan

- Increase in value

- Refinancing

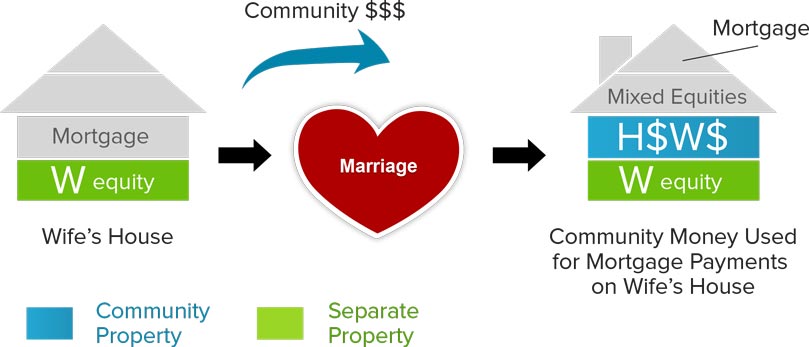

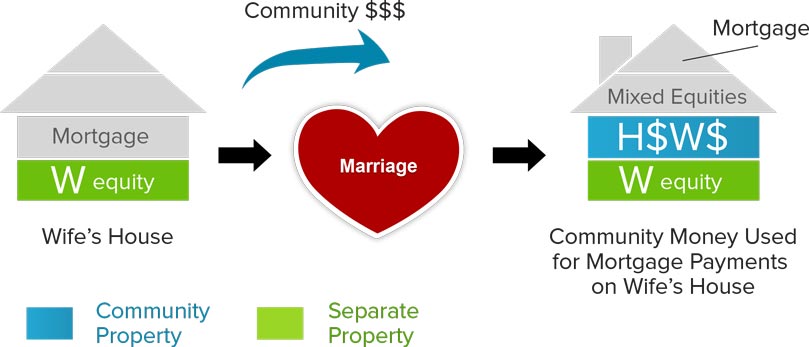

Can the Community Acquire an Interest in the Separate Property House of One Spouse?

Community Money Used For Separate House

California family law dictates that the community may acquire an interest in real property if community funds are used to make principal payments on a mortgage secured by a residence owned solely by one spouse (IRMO Moore/IRMO Marsden). Payments on an interest only loan do not create a right to reimbursement or an ownership interest in the property.

If community money is used to improve a separate property property, there may be a right to reimbursement.

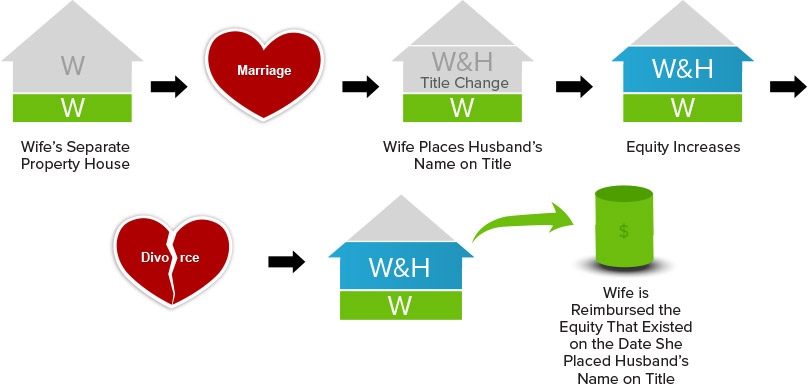

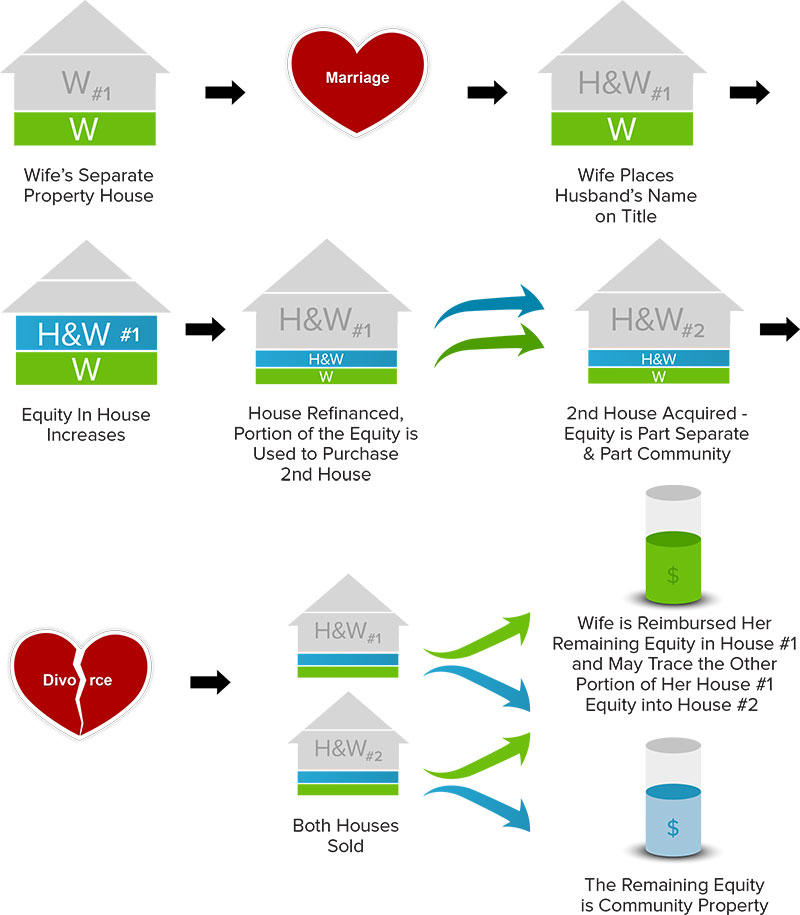

Does Placing the Other Party's Name on the Title of a Separate Property Home Constitute a Gift of One-Half of the Equity in the Home?

Title Changed

The amount of equity that exists on the date the owner-spouse places the other spouse’s name on title to his or her separate real property will generally remain his or her separate property (without any appreciation or interest) unless a specific waiver of Family Code Section 2640 is made. In other words, if, on the date the property is transferred into joint names, the equity equalled $500,000, the party who originally owned the property would receive the first $500,00 of equity in the property upon divorce unless that party executes a Family Code Section 2640 waiver.

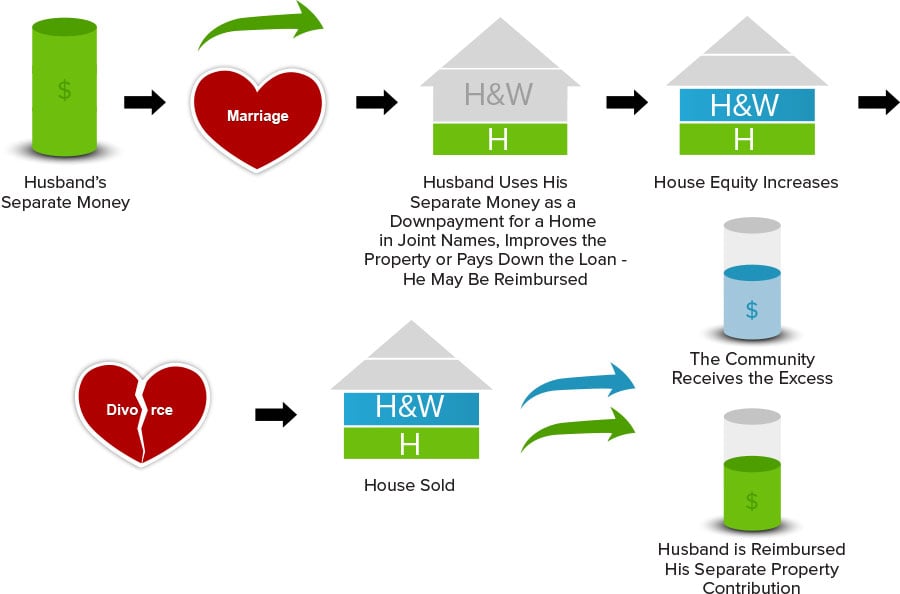

If One Party Uses His or Her Separate Funds for the Down Payment on a Jointly Titled Home Is That Party Reimbursed?

Separate Money Used Re: Joint House

If a party uses his or her separate funds to acquire real property in joint names, or pay down the loan on jointly owned real property, he or she may be reimbursed if that party can trace the separate funds back to a separate property bank account or prove the facts in some other way. Reimbursement of separate funds used to improve real property in joint names is generally limited to the increase in value resulting from the improvement to the property paid for with separate funds.

Can Reimbursement Rights Apply to Separate Property That is Traced Into the Purchase of Multiple Properties?

Refinance

If an asset is purchased with funds obtained through the refinance of a jointly owned house that was originally the separate property of one spouse, upon divorce, that spouse may be reimbursed the equity that existed on the day the house was transmuted into joint names. If the spouse who originally owned the first house as separate property can trace the equity that they had in the first house that was accessed through a refinance and used to buy a second house, that party may be entitled to reimbursement (IRMO Walrath).

In other words, if a wife owned a home before the date of marriage and added the husband’s name on the title at a time when the equity in the home equaled $1,000,000, she could be reimbursed the portion of that $1,000,000 obtained from a refinance, if it was used to buy another home and she could trace the transaction.

What is Tracing?

Direct Tracing

Tracing may be used to uncommingle bank or brokerage accounts and to trace separate funds used to purchase an asset that is titled in joint names. Tracing is also used relative to certain reimbursements to the separate property of one spouse or to the community.

Is There More Than One Type of Tracing?

There are two basic types of tracing:

- Direct Tracing Method (mechanical tracing)

- Family Expense (Recapitulation) Method

Tracing can be used to benefit either the separate property of one spouse or the community. Tracing can be very expensive and a party generally will not know if the tracing will be successful until after it is complete.

The court has the authority to allow tracing that does not totally comply with the traditional tracing rules so long as it does not rely on speculation and does not violate any other family law principles.

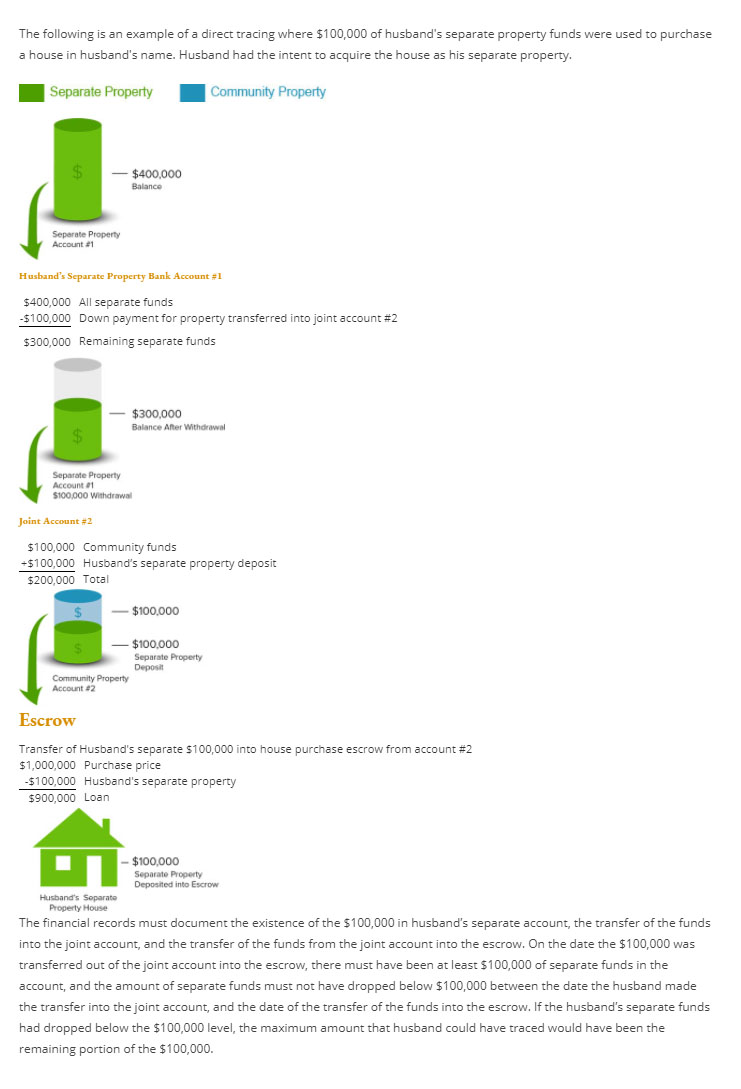

What is Direct Tracing?

Direct Tracing Example

The Direct Tracing Method is the favored method of tracing. Direct tracing requires the transaction by transaction tracing of funds from a separate bank account or source into the purchase transaction. The separate funds must be shown to have been present in the bank account on the date when the purchase transaction occurred. There may be additional factors that come into play for the tracing to be successful. If separate funds were transferred into a community account prior to the purchase transaction, each transaction occurring between the deposit and the subject transaction must be analyzed. Specific detailed tracing requirements must be met.

For example, if a husband was attempting to trace $100,000 into a real estate purchase escrow account the tracing exercise could look like the steps set fourth below. The documents must show the existence of the $100,000 in husband’s separate account, the transfer of the funds into the joint account, and the transfer of the funds from the joint account into the escrow. On the date the $100,000 was transferred out of the joint account into the escrow, there must have been at least $100,000 of separate funds in the account, and the amount of separate funds must not have dropped below $100,000 between the date the husband made the transfer into the joint account, and the date of the transfer of the funds into the escrow. If the husband’s separate funds had dropped below the $100,000 level, the maximum amount that the husband could have traced would have been the remaining portion of the $100,000.

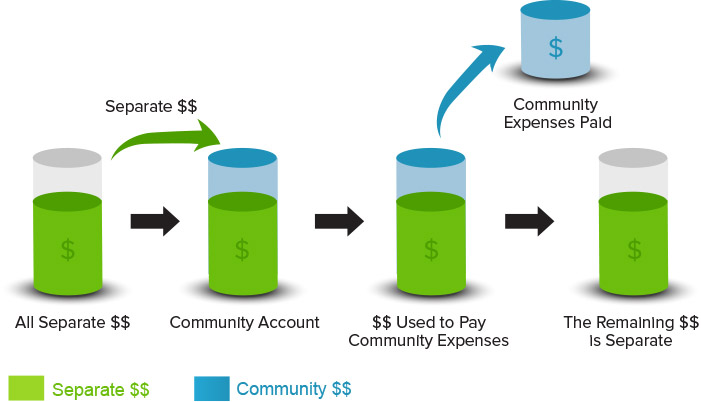

What is Family Expense Tracing?

Family Expense (Recapitulation) Tracing

The second method of tracing is referred to as the Family Expense or Recapitulation method. This method may be used when the records that would prove the tracing do not exist to complete a direct tracing and the unavailability of the records is not the fault of the party seeking to trace his or her separate property.

The divorce court may conclude that the asset in question was purchased with separate funds, if the party can prove that at the time of the purchase transaction, there were no community funds available to make the purchase. This may be proven by demonstrating that the community expenses at the time of the transaction equaled or exceeded the community income, thus showing that there could not be community funds in existence.

Community expenses paid with funds from a commingled (containing community and separate funds) account are presumed to be paid with the community funds contained in the account, as opposed to one spouse’s separate funds contained in the same account. This rule is referred to as the “community expense presumption.” In other words, the community funds in a commingled account are used first, if the expenditure is for community expenses.

Is a Trial in a Divorce Case Similar to a Trial in Other Areas of Law?

Evidence, Presumptions and Privileges

Family law is made more complex than is generally thought because the courts follow the Evidence Code and the Code of Civil Procedure.

A trial in a divorce case is not dissimilar to a trial in other civil or business litigation with the exception that divorce cases do not involve a jury. The California Code of Civil Procedure and the Evidence Code must be followed. Trials may be very complex proceedings that are often lost due to a lack of understanding of procedural rules or the rules of evidence.

Do Divorcing Parties Owe Each Other the Same Duties That Partners Owe Each Other?

Fiduciary Duties

Fiduciary duties owed by each party to the other require full disclosure of all relevant material facts, and information regarding both community and separate property assets and debts. There may be harsh penalties for breaching these duties.

Parties to a divorce should be prepared to make voluntary, full and immediate financial disclosures to their spouses, as required by their fiduciary duties. The fiduciary duties require each party to act with the utmost good faith toward the other. Both spouses are bound by fiduciary duties to one another during marriage, until the divorce has been finalized and the property is divided. Sections 721(b), 1100(e), and 2100(e) of the California Family Code set forth the rules and requirements. Essentially, these are the same fiduciary duties that are set forth in the California Corporations Code. Divorcing spouses are treated like business partners in this respect.

What is Involved in the Valuation of a Business in a Divorce Case?

Initial Characterization of Business

Asset Based Approach

Income Based Approach

The State Bar of California recognizes divorce as a specialized practice area. Representing clients in divorces that involve the valuation of business interests is even more specialized. Handling these matters requires a working knowledge of family law valuation principles, taxation, compensation issues, accounting principles, general foundational business knowledge, and the complex and conflicting divorce valuation, case law, and divorce litigation practicalities.

Representing a party in a divorce involving a business interest requires the retention of a divorce business valuation expert. They can be invaluable in negotiation and reaching a settlement, as experts often collaborate to reconcile differences in their findings and opinions. In many cases the divorce court will actually order the accountants to meet and confer long before the trial to attempt to resolve their differences.

How is Goodwill Calculated in a Family Law Matter?

Goodwill

In arriving at a goodwill value, the following factors, are considered: total compensation of operator-owner, reasonable compensation, rate of return on tangible assets, and multiplier/ capitalization rate.

Are There Situations Where the Community is Credited With or Reimbursed a Portion of the Other Party's Separate Property?

When community and separate property, money and/or services are commingled, there may exist an issue as to whether the asset is separate, community or mixed. A family law court may be asked to apportion an increase in the value of an asset between community property and the separate property of one party in an equitable manner. There may also exist an issue as to whether there is a right to reimbursement relative to the separate or community estate. The determination of these issues is fact driven. Gray areas are often decided in the divorce courts in favor of the community. These issues are often determined based on which party has the “burden of proof.” There are presumptions that favor the community estate and there are presumptions that favor the separate estate. Some presumptions may be overcome with evidence. Family law courts may be required to rule on characterization and apportionment issues relative to bank accounts, brokerage accounts, stock options, businesses, real estate and many other assets.

An example of equitable apportionment may exist when, during the marriage, when a spouse works in his or her separate property business that increase in value during the marriage. The community may be entitled to a portion of the increase in value of the business during the marriage.

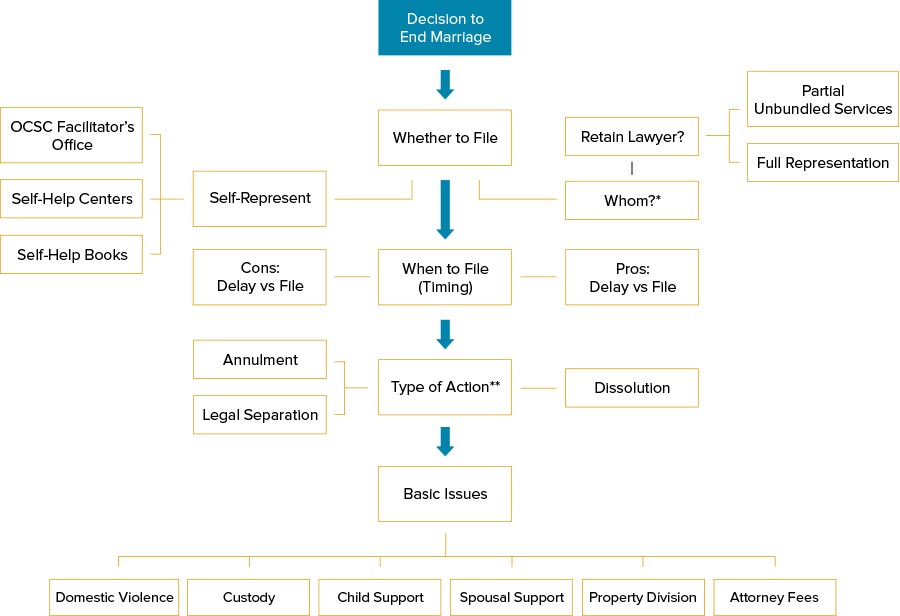

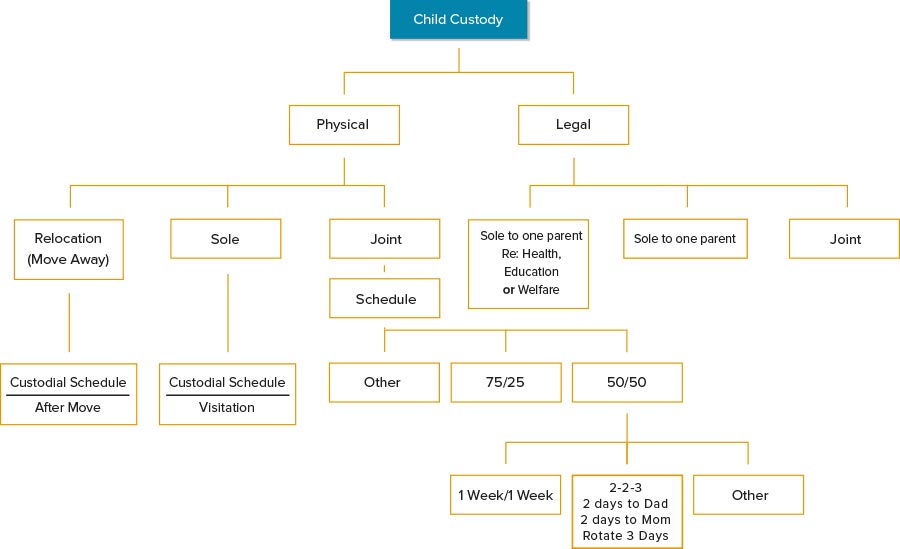

How Do Parties Resolve Custody Disputes if They Cannot Reach an Agreement?

If the parties cannot arrive at an agreement resolving all custody and visitation matters, the family law court will make the necessary decisions, including physical custody and legal custody. These orders are made after a hearing or trial, at which the parties’ other witnesses may testify. The court may make orders regarding a variety of other related matters, like education or the relocation of a child’s residence.

Does a Divorce Lawyer Need Specialized Skill and Training to Competently Handle Child Custody Matters?

Competently handling child custody disputes requires an Orange County divorce lawyer with a number of different and distinct lawyering skills. Handling child custody matters is very different than handling a business valuation issue. To be effective in child custody matters, a divorce lawyer must be a skilled trial lawyer and be knowledgeable about the nuances of child custody law. A divorce lawyer must be intimately familiar with the statutes and case law related to child custody and move away matters. It is critical that a divorce lawyer stay current on the statutes and cases, as they change frequently and often without notice. Changes may be minor, but any change can impact the outcome of a child custody case dramatically. An Orange County divorce lawyer must also be conversant with the many issues that relate to Evidence Code Section 730/Family Code Section 3111 child custody evaluations, and the psychological testing that is utilized in the evaluation process.

Do All Courts Handle Child Custody Matters the Same Way?

Evidence, Presumptions and Privileges

A divorce lawyer must be acutely aware of the way the judges view child custody issues. Judges are people and different people, have different philosophies about child custody, move away issues, Evidence Code Section 730/Family Code Section 3111 evaluations, parenting, etc. The various branches of the Superior Court in the State of California are not uniform in the area of child custody litigation. There are distinct differences between the counties as to how child custody and child visitation matters are determined.

Do the Minyard Morris Divorce Lawyers Handle Cases in Other Counties?

Our Orange County divorce lawyers believe that it is in a client’s best interests to be represented by a divorce lawyer whose practice is located in the county where the child custody case is filed. In other words, we do not believe it is in a client’s best interest for an Orange County divorce lawyer to accept a child custody case filed in Los Angeles, or vice versa. There is significant value in having a lawyer who is familiar with the local court’s practices, philosophies, and rules. Logically speaking, would a parent in a child custody dispute rather be represented by a lawyer who spends 100% of his time in the Orange County courts, or in several different counties?

Does a Child Custody Lawyer Need to Be a Skilled Trial Lawyer?

A divorce lawyer must also be an experienced and proficient litigator. It is essential for the divorce lawyer to be intimately familiar with the rules of evidence, burdens of proof, and privileges that relate to child custody litigation, in order to avoid potentially disastrous results in trial. A child custody trial is a trial, not a conversation with a judge. If a divorce lawyer is not competent in the area of evidence, they may be unable to present crucial facts to the divorce court. If the court sustains an evidentiary objection, that means the answer to the question will not be heard by the court. A skilled divorce lawyer may be able to prevent the other party from testifying on the most important parts of the case. In other words, a divorce court may not ever hear the story that needs to be told. The divorce court will not have the opportunity to make an informed decision regarding child custody if it does not hear all of the facts.

Is There a Value to a Client Being Represented by a Large Family Law Firm?

It is a significant advantage to our clients that our Orange County divorce lawyers collaborate as a team on unique child custody and visitation matters. Generally, we meet as a team three times each week to brainstorm and strategize our clients’ unique cases. These meetings are not informal chats, they are formal meetings with specific agendas. Our clients do not hire one lawyer, they hire the entire firm. Our firm has over 200 years of combined Orange County legal experience that is leveraged for the benefit of our clients. It would be difficult, for a team of experienced divorce lawyers who limit their practice to Orange County family law matters not to create a better approach and strategic plan for child custody negotiations or litigation than would result from a one-man band or its equivalent.

When Should a Client Expect to Hear a Divorce Lawyer's Detailed Analysis of Their Child Custody Matter?

A client should expect their divorce lawyer to be beyond candid, and explain to them the strengths and weaknesses of the case, and the probable outcome of litigation at the first attorney-client meeting and at every stage during the process, as new facts unfold. A client should have the opportunity to make informed and timely decisions about their children. Our Orange County divorce lawyers are known for telling our clients the good, the bad, and the ugly about child custody matters – early and often. Clients deserve to hear the truth, not a sales pitch.

Should Clients Attempt to Settle Their Child Custody Disputes?

Child custody litigation is not the preferred way to resolve child custody disputes. The parties should take all actions reasonably appropriate to resolve child custody conflicts between themselves. Litigation is expensive, time consuming, unpredictable, and often results in long term conflict with the other party. Continued conflict is never in the best interests of a child. Before engaging in child custody litigation, one should carefully evaluate whether the likely level of emotional damage caused to a child and oneself in litigation will be significantly less than the emotional damage resulting from a compromised settlement. Before a party engages in child custody litigation, they should be carefully analyze the likelihood of prevailing. The definition of a win should be carefully analyzed, as well. For example, is it a win for a party to receive one additional custodial day every two weeks? Significant time should be spent doing a cost benefit analysis. Parties should only elect to fight a child custody battle, if they believe there is no realistic alternative.

Are All Child Custody Lawyers Created Equal?

If a party elects to engage in child custody litigation, the selection of the Orange County divorce lawyer should be made very carefully. The selection of the right divorce lawyer can often be the difference between a victory and a loss. Use common sense in determining who to hire. Study a lawyer’s website, evaluate their reviews to assess their credibility, and most importantly, interview the specific lawyer who will try your case, if your matter goes to trial.

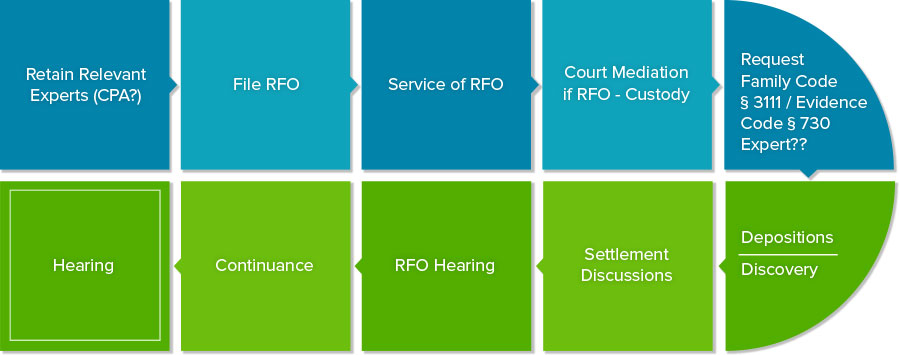

What Are the Different Phases of Child Custody Litigation?

Potential Sequence of Procedural Events in Child Custody Litigation

Child custody litigation may involve many different events, steps and stages. Temporary child custody orders are made at the Request For Orders (RFO) stage. Significant written discovery and depositions may be necessary, and experts may be retained before permanent orders are made at the divorce trial.

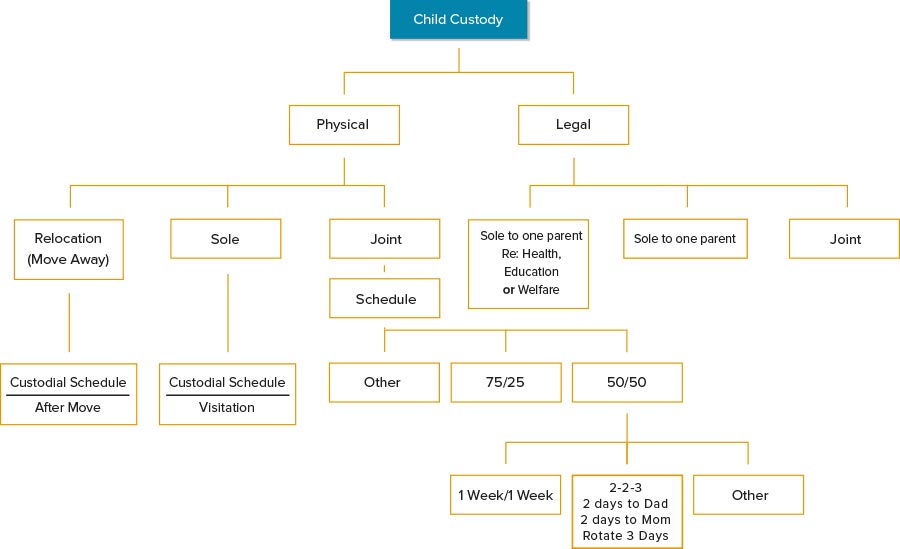

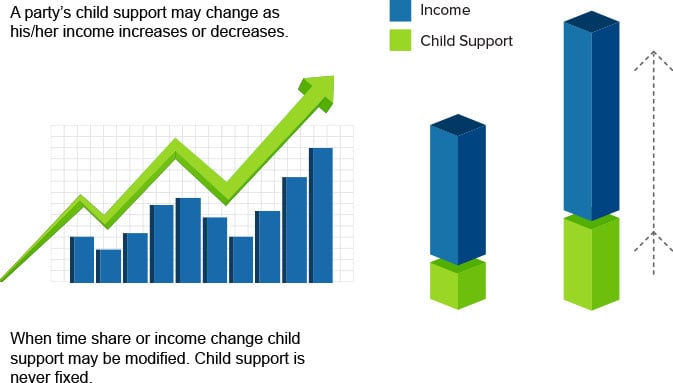

Can Child Custody Impact Other Parts of a Divorce?

Family Law Interconnectivity Overview – Children

Child Custody Decision Tree

A child custody case is not simply establishing a time-sharing schedule. Child custody issues and orders may impact whether a parent can relocate to obtain a better job. Child custody orders relate directly to the amount of child support ordered, and other related issues. As the time share percentage of the payor decreases – child support may increase. As income of the payor increases – child support increases. The terms of a child custody order, and the amount of child support, may impact decisions as to whether to retain the family residence. Retaining a family residence may impact decisions about seeking an award of other assets.

There are many decisions that must be made relative to child custody matters. A person should have all of the relevant facts before making decisions about the children. The analysis should be made with a person’s divorce lawyer, therapist, and advisors. Many decisions relative to child custody impact other decisions related to child support, property division, etc. Careful consideration should be given to personal preferences, every day practicalities, and the children’s short term and long term best interests.

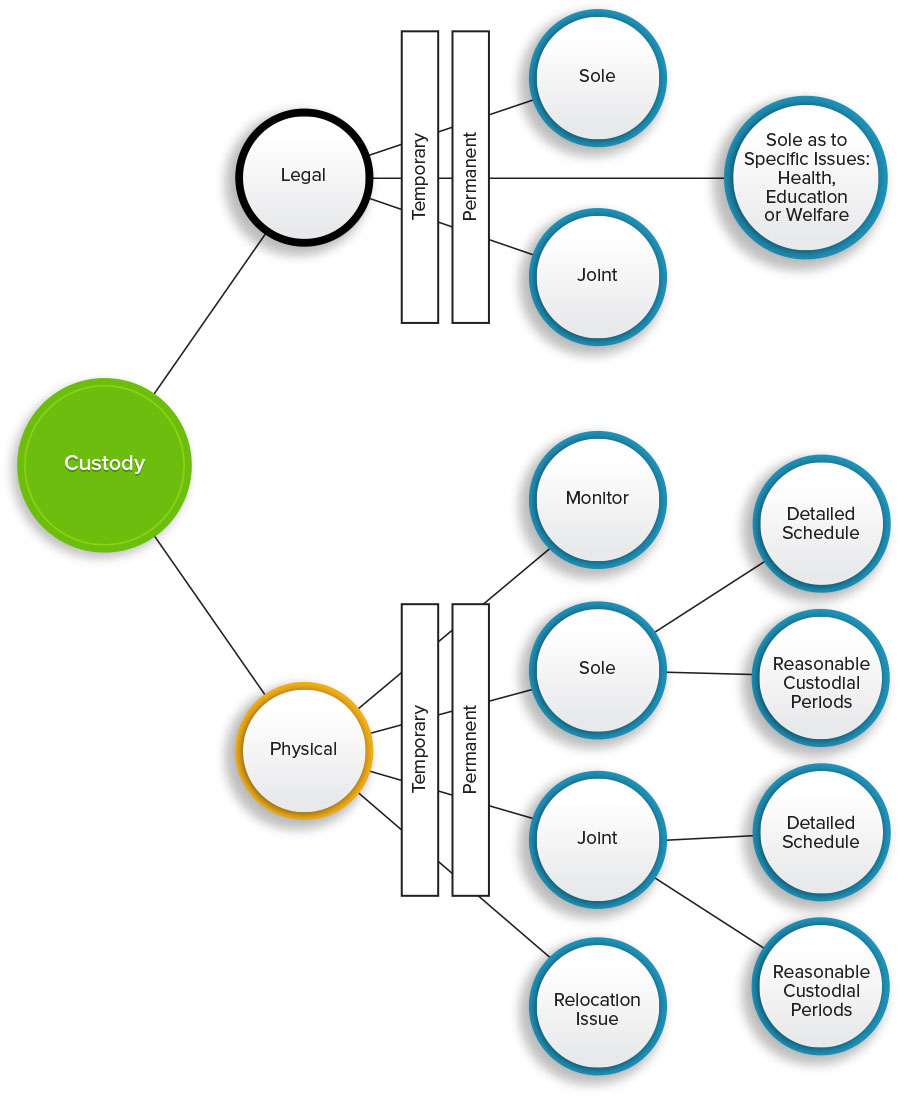

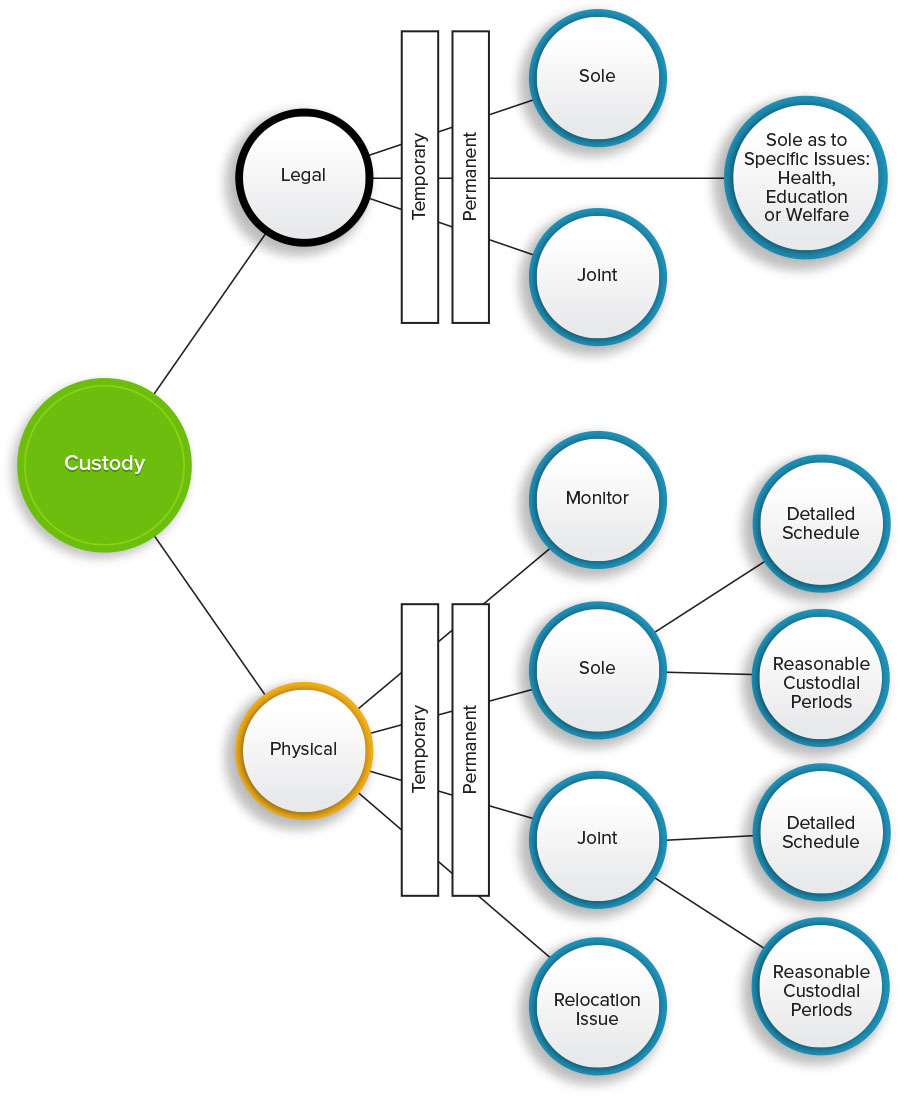

How Does Legal Custody Differ From Physical Custody?

Physical and Legal Custody

Legal child custody addresses the right and responsibility to make decisions regarding a child’s health, education, and welfare. Parties are generally awarded joint legal child custody in Orange County Superior Court.

In unique situations, a family law court may award legal child custody to one parent in a designated area: education, extra-curricular activities, or medical issues. This type of child custody order may be made when the parties have a history of high conflict in one of these specific areas, and have demonstrated an inability to co-parent.

Most courts in Orange County are reluctant to make orders designating which school a child should attend, and courts will often award legal child custody to one parent on educational issues and authorize that parent to make the school selection decisions.

Physical child custody addresses where a child resides.

Parties may have joint or sole legal child custody and physical child custody.

What is Legal Child Custody?

Physical and Legal Custody

Legal child custody addresses the right and responsibility to make decisions regarding a child’s health, education and welfare. Parties are generally awarded joint legal child custody in Orange County Superior Court.

In unique situations, a family law court may award legal child custody to one parent in a designated area: education, extra-curricular activities or medical issues. This type of child custody order may be made when the parties have a history of high conflict in one of these specific areas and have demonstrated an inability to co-parent.

Most courts in Orange County are reluctant to make orders designating which school a child should attend and courts will often award legal child custody to one parent relative to educational issues and authorize that parent to make the school selection decisions.

What is Physical Child Custody?

Physical child custody addresses where a child physically resides, and the parenting time of each parent. A physical child custody order determines which parent has supervision rights and responsibilities for the child during designated periods. The parties may be awarded joint physical child custody, or physical child custody may be awarded to just one party. Joint physical child custody does not necessarily mean equal time sharing. A 70/30 time share could be labelled joint child custody. The parties may be awarded joint physical child custody, with one parent being designated as the primarily custodial parent.

Divorce courts in Orange County rarely split sibling’s between the parents. It is generally believed that it is in the sibling’s best interests to live together.

Is Child Custody Mediation Required in Contested Orange County Family Law Matters?

Before any contested child custody matter may be presented in a divorce court, the parties must attend court mandated child custody mediation. If one of the parties fails to attend the child custody mediation, the custody consequences may be sanctions and/or a delay in the proceedings. In Orange County, child custody mediation is confidential and the results of the child custody mediation are not reported to the judge unless a child custody agreement is reached. The rules are different in other counties.

Divorce lawyers do not accompany the parties in the child custody mediation sessions.

It is important to speak with an Orange County divorce lawyer prior to the child custody mediation in order to understand the process, purpose, goals and most likely result in court if an agreement is not reached in mediation.

It is critical to understand that an agreement is reached in mediation, that agreement will likely be the order that will control custody for years to come. Although child custody orders can be modified, it is not always easy to do so. The child custody mediator will report any agreements to the Orange County family law Judge assigned to the case.

If a party cannot attend the mediation, he or she must telephone the mediation office and reschedule the appointment.

What is Child Custody Mediation?

Before any contested child custody matter may be presented in a divorce court, the parties must attend court mandated child custody mediation. If one of the parties fails to attend the child custody mediation, the custody consequences may be sanctions and/or a delay in the proceedings. In Orange County, child custody mediation is confidential and the results of the child custody mediation are not reported to the judge unless a child custody agreement is reached. The rules are different in other counties.

Divorce lawyers do not accompany the parties in the child custody mediation sessions.

It is important to speak with an Orange County divorce lawyer prior to the child custody mediation in order to understand the process, purpose, goals and most likely result in court if an agreement is not reached in mediation.

It is critical to understand that an agreement is reached in mediation, that agreement will likely be the order that will control custody for years to come. Although child custody orders can be modified, it is not always easy to do so. The child custody mediator will report any agreements to the Orange County family law Judge assigned to the case.

If a party cannot attend the mediation, he or she must telephone the mediation office and reschedule the appointment.

Will the Divorce Courts Allow Parents to Design Their Own Custody Schedules?

The parties may agree to resolve their differences in child custody and child visitation matters. If the parties reach an agreement, they are not required to attend a court mandated child custody mediation. The Orange County divorce court will sign a child custody stipulation, and rarely questions the parents’ decisions in these matters.

Can Parents Agree to Non-Modifiable Child Custody Orders?

The divorce court will not honor an agreement between the parties that designates a child custody agreement as non-modifiable. The divorce court always retains jurisdiction to modify all aspects of child custody orders.

In other words, the parties cannot prevent the divorce court from making orders in the future that modify the terms of their child custody agreement (IRMO Goodarzirad).

The parties cannot deprive the court of its ability to allow one party to relocate with a child (IRMO Abrams)

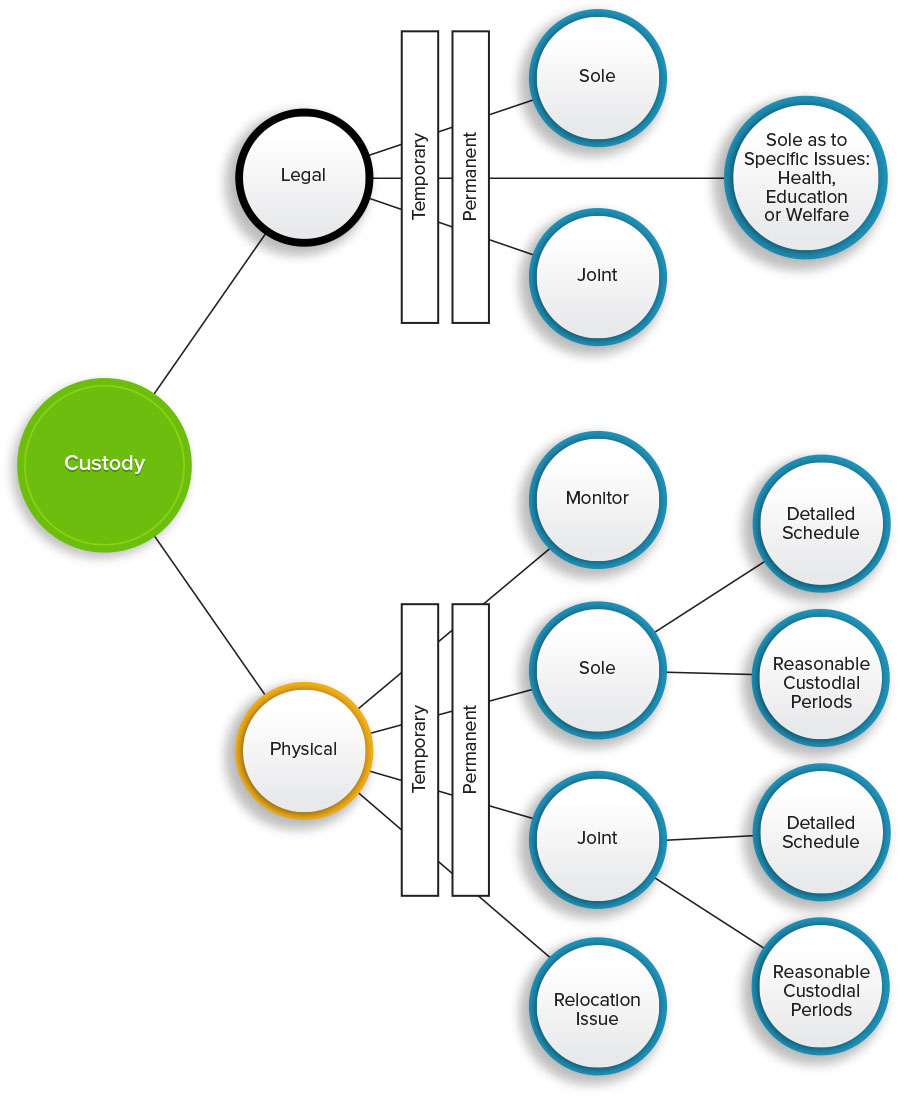

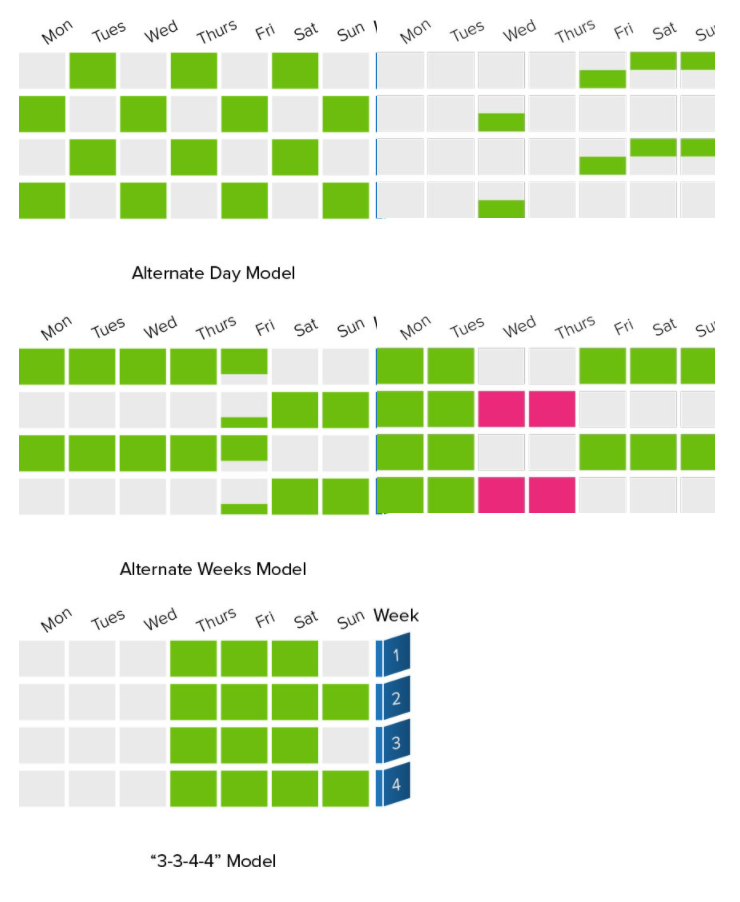

Do Parents Have Discretion in Developing a Parenting Plan?

Child Custody / Parenting Plan Models

The parties may agree to a child custody parenting plan that is appropriate for their circumstances. If they do not agree, the divorce court will set the parenting plan that they believe is in the child’s best interest.

The objective in designing the custodial schedule is to meet the needs of the child and the parties. The practicalities of a child’s schedule and work schedules of both parties can make creating a mutually acceptable child custody time share schedule problematic. It is critical to understand that although each party’s work schedule and needs may change, once an agreement is reached, it is not easy to modify.

What Factors Do Family Law Courts Evaluate When Making Child Custody Orders?

Divorce courts look at many different factors relative to making its child custody orders including the factors set for the below:

- Age and maturity of child

- Child’s preference

- Health, education, and welfare of the child

- Relocation of child’s residence

- Mental/emotional disorders of a parent or child

- Special needs of the child

- Cooperation or lack of cooperation between the parents

- Domestic Violence

- Work schedules of the parents;

- Parenting skills

- Relationship between the child and each parent

- Educational needs of the child

- Cultural factors

- Criminal activity

- Parental support systems

- Parent’s willingness to promote continuous and frequent contact with the other parent

- Drug use

Can a Family Law Court Base a Child Custody Order on Economic Circumstances?

A child custody order may not be made based on the comparative economic circumstances of the parents (Burchard v. Garay).

What is a 730 Child Custody Evaluation?

In some contested child custody cases, the divorce court may order the parties to participate in an Evidence Code Section 730/Family Law Code Section 3111 child custody evaluation, performed by a mental health professional who makes recommendations to the divorce court about a child custody and related matters.

An Orange County family law court is not required to approve the parties agreement to retain an Evidence Code Section 730/Family Law Code Section 3111 expert to conduct a child custody evaluation. Most Orange County divorce courts do not automatically grant requests for child custody evaluations for a variety of reasons.

Evidence Code Section 730/Family Law Code Section 3111 child custody evaluations delay the resolution of a contested child custody case by four months or more and child custody evaluations can cost tens of thousands of dollars.

The child custody evaluator interviews the parties, the children, and may interview neighbors, friends, doctors, therapists, relatives, teachers, or other individuals that have relevant information. The evaluator may visit the home of each parent to perform a “home visit.”

Typically, the child custody evaluator will meet with the parties alone, the parties together, each party with the children, and the parties and the children together. The divorce lawyer does not accompany a client in the sessions.

The appointment of a child custody evaluator can increase the attorneys fees on both sides, as a counter expert may be retained, deposing the individuals interviewed by the child custody evaluator, lengthening the trial itself due to the additional witnesses and potentially expanded issues.

What Experts May a Family Law Court Appoint in a Child Custody Matter?

The Potential Family Law Team

The divorce court may, on its own motion, or at the request of a divorce lawyer, order an Evidence Code Section 730/Family Code Section 5111 child custody evaluation, a “child custody investigation” (CCI), or appoint an Orange County divorce lawyer to represent a child (minor’s counsel). The divorce court may also order the parties to participate in therapy relative to child custody for a limited period of time.

Are Experts Always Retained in Child Custody Matters?

Frequently, child custody matters often do not involve experts and on occasion, more than one expert is retained by each side of a case. Whether or not to involve an expert in a child custody case is a critical strategic decision that should be carefully evaluated with the divorce lawyer. It is critical to retain the “right” expert as, with divorce lawyers, all experts are not created equal.

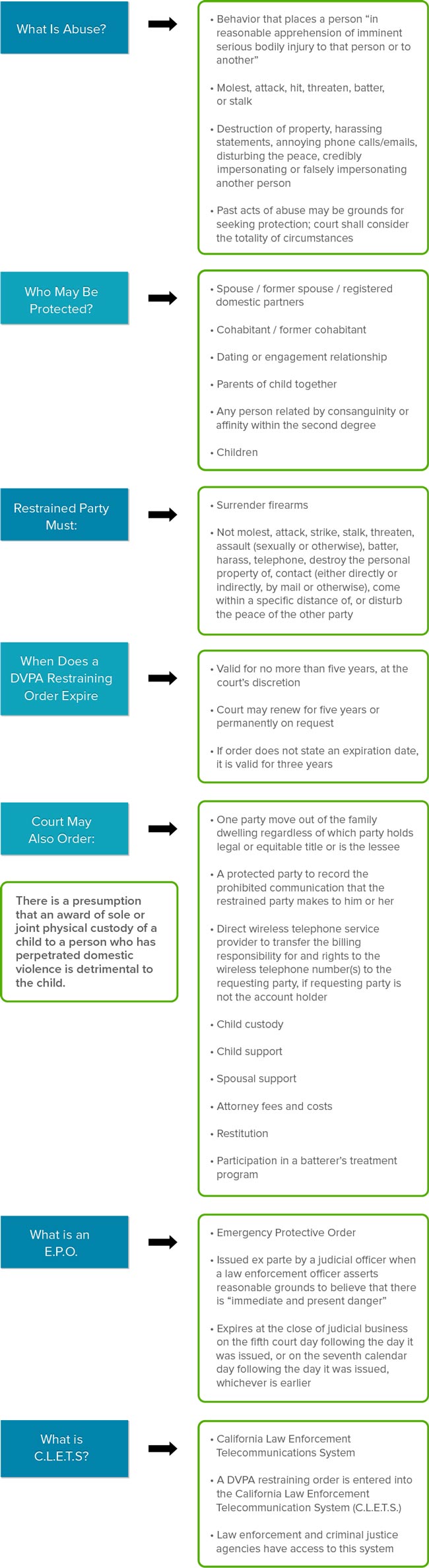

Is Domestic Violence Considered by Orange County Family Law Courts When Making Child Custody Orders?

Domestic Violence

Documented domestic violence may significantly impact a divorce court’s child custody orders.

Divorce courts are directed, by statute, to take domestic violence into consideration in making child custody orders. An award of joint legal child custody, or physical child custody, to a parent who has been found to have committed domestic violence in the last five years is presumed to be detrimental to a child’s best interest (Christina L. v. Chauncey B., IRMO Fajota, and Celia S. v. Hugo H.).

The consequences of committing domestic violence can be serious and long term. Many actions constitute domestic violence, including stalking, blocking passage, taking possession of another’s cell phone, implied threats. Obviously, each event is fact driven, must be taken in context, and may be interpreted differently by different family courts.

Child custody, visitation, and child support orders survive the end of or termination of a DVPA protective order (Moore v. Bedard).

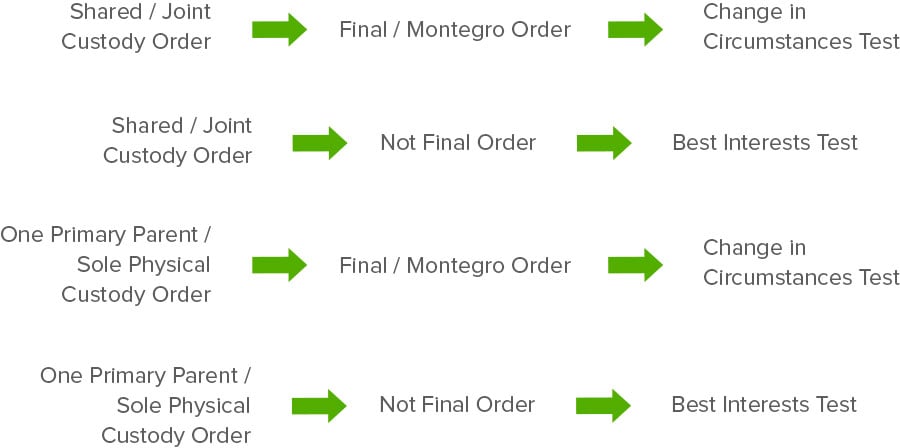

When Does a Family Law Court Use the Best Interests of a Child Standard as Opposed to Change of Circumstances Standard in Making Child Custody Orders?

Best Interests of Child

If the divorce court is asked to make orders relative to child custody, it will make the determination based on the best interests of the child unless the hearing is the modification of a “final” order (Montenegro v. Diaz) and in that case, the test will be whether there has been a “substantial change of circumstances.” (Burchard v. Garay)

The divorce court considers many different factors in determining “best interests” or “change of circumstances.” These two concepts are somewhat vague and subject to interpretation. Results of child custody litigation are not overly predictable by divorce lawyers. Different Judges may rule different ways on the same set of facts. Divorce courts have wide discretion in child custody litigation and reversing a divorce court’s child custody order on appeal is rare given the high degree of discretion.

The parties may not contract with each other or stipulate as to a particular standard of review relative to future child custody orders and the divorce court would not be bound by such stipulations. In Marriage of Cohen, the court ruled that parties could not bind the court relative to child support orders and the same rule would apply to child custody orders. (IRMO Cohen)

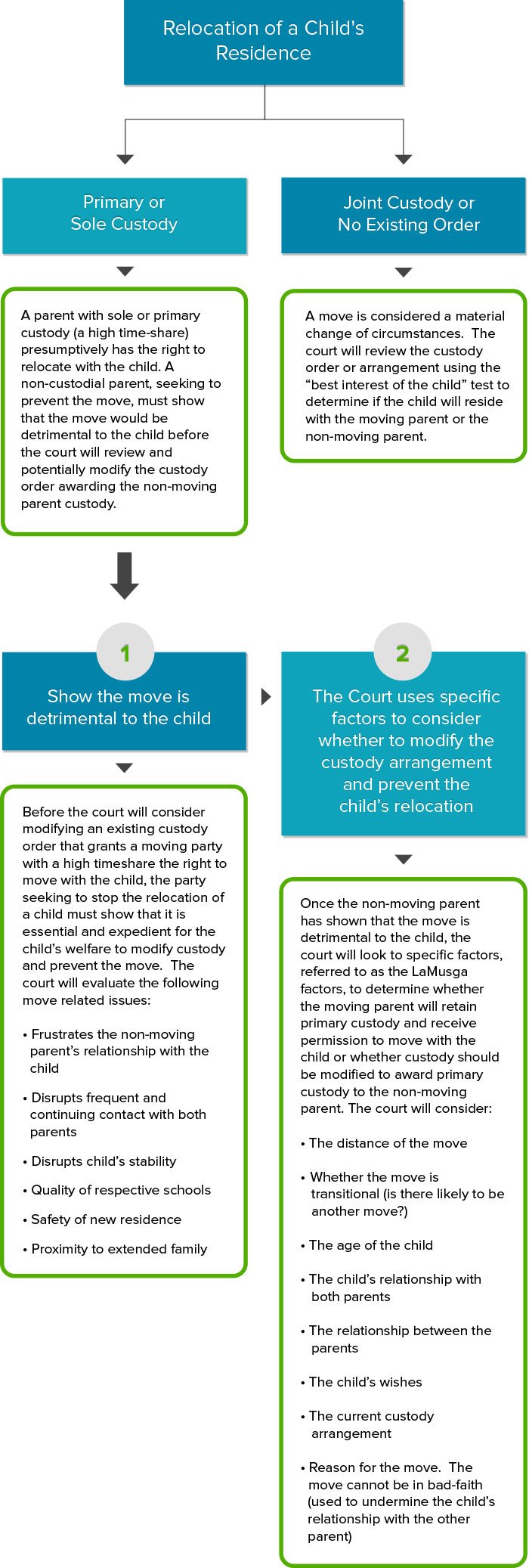

Does a Custodial Parent Have the Right to Change the Residence of a Child?

Even a parent with sole legal and physical child custody does not have the absolute power to relocate a child’s residence. (Brown and Yana).

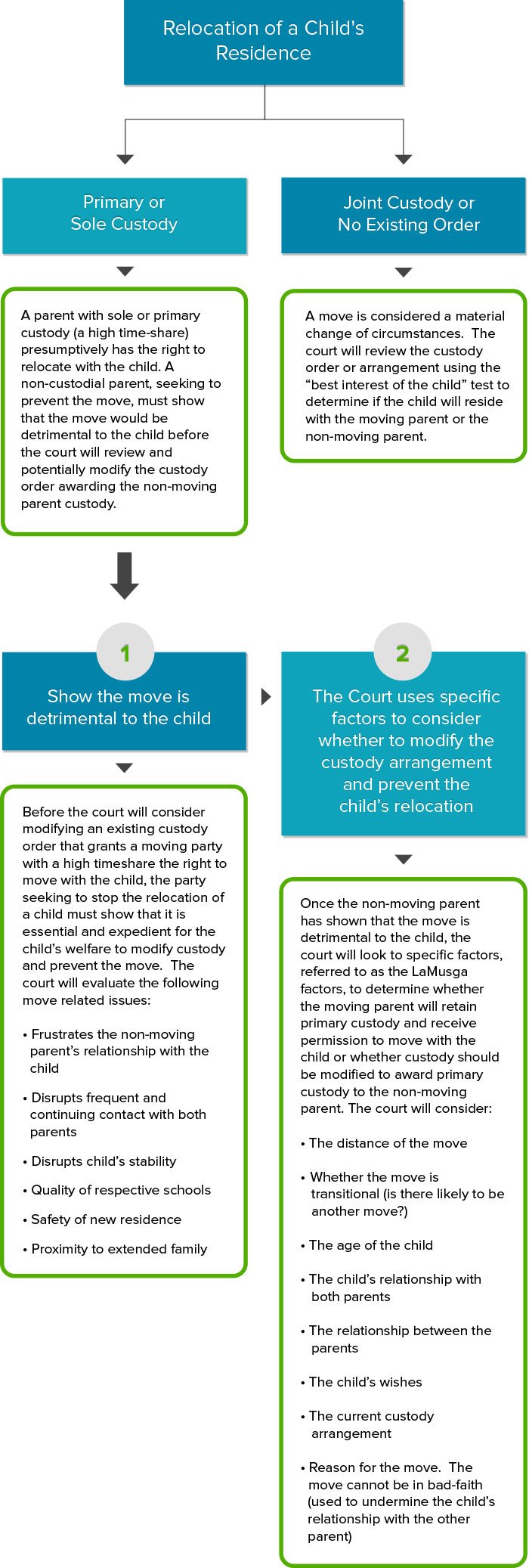

How Does a Family Law Court Analyze a Relocation or "Move Away" Issue?

“Move Away” Case

If one parent makes the decision to attempt to relocate the child’s residence, a child custody order must be modified, in one way or another. A party will, of course, be able to relocate their own residence, but that parent will not necessarily be allowed to change the residence of the child. When a divorce court is making a determination as to whether a parent may relocate a child’s residence, the divorce court must assume that the parent will actually move, regardless of whether the court allows the party to relocate the child’s residence. A divorce court cannot create two separate orders, one if the parent decides to move, and another if they do not. In other words, a divorce court must make an order that the child will live primarily with the moving parent, or primarily with the non-moving parent.

There is a great burden on a non-custodial parent who is attempting to modify custody and relocate a child’s residence. (Jane J. v. Superior Court).

Does a Parent with Physical Child Custody Need to Prove That the Move is "Necessary?"

If a child custody order has previously designed one parent as the primary custodial parent, the moving parent does not need to prove that the move is necessary. (IRMO Burgess) A parent opposing the move must show that the move would be detrimental to the child. (IRMO LaMusga). If detriment is proven by the non-moving parent, then a divorce court must evaluate all of the relevant factors to determine whether relocation or a change of child custody to the non-moving parent is in the child’s best interests.

What Factors Does a Family Law Court Look to In Determining Whether to Allow a Parent to Relocate a Child's Residence?

A divorce court will look to a number of factors in making the determination in the relocation of a child’s residence including, but not limited to: the extent of shared custody, willingness to place the children’s best interests first, reasons for the move, relationship of the child with each parent, distance of the move, age of the child, ability of the parents to cooperate and communicate, stability and continuity, relationship of the parents, and the child’s wishes.

Is a Hearing Generally Required for a Move Away Determination?

Where parents have a working shared child custody arrangement, a divorce court must conduct a hearing to determine whether a relocation of the child’s residence is the child’s best interests. (IRMO Cohen).

If a child custody order has not been made, or if the child custody order is not a “final” order, the divorce court will use the ‘best interests of the child’ test in making the decision on the relocation, versus the “change of circumstances test,” which is a heavier burden.

The parties cannot contract with each other to prevent the divorce court from allowing one parent to relocate a child’s residence. (IRMO Abrams).

A divorce court cannot require a parent with lower financial resources to relocate (IRMO Fingert) to live near the child.

Can Child Custody Orders be Changed?

Child custody orders are always modifiable. The parties cannot validly contract with each other to not seek to modify or change the child custody arrangement in the future. The divorce court always retains jurisdiction to change child custody orders. (IRMO Goodarzirad).

Generally, the divorce court will only modify “final” child custody orders if there is a showing of a substantial change in circumstances between the date of the existing order and the hearing. (Montenegro v. Diaz). If the order is not “final”, the divorce court will base its decision for modification on the “best interests” of the child. Additionally, the parties cannot bind the family law court to follow a specific standard of review at future custody hearings.

What Are Examples of a Change of Circumstances in the Context of a Modification of a Child Custody Order?

Examples of possible circumstances that may warrant a modification of child custody order:

- Child’s preference and age;

- Work schedule;

- Move away (relocation);

- Poor parenting/negligence;

- Child abuse;

- False allegations of abuse;

- Domestic violence;

- Interference with parent/child relationship (alienation); and

- School related issues.

Are There Situations Where a Change of Circumstances is Not Required for a Court to Modify the Child Custody Order?

Divorce courts will not modify temporary child custody orders unless there is a substantial change of circumstances since the last order. In fact, divorce courts are reluctant to make changes in temporary custody orders under any circumstances, unless a child’s safety is involved. Divorce courts seek to have only one child custody trial.

In some situations, the simple changing of the residential arrangements (timeshare) may not constitute a change in child custody. In this situation, a showing of a substantial change of circumstances may not be required (IRMO Birnbaum). Some minor changes in a schedule may not be a change in custody, and may not require a substantial change in circumstances.

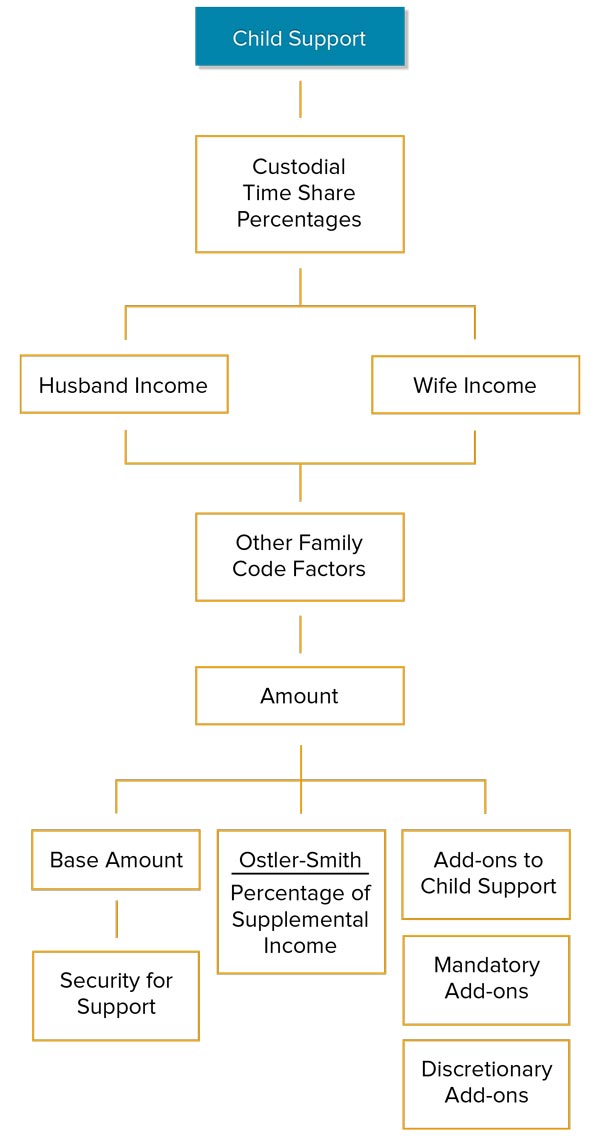

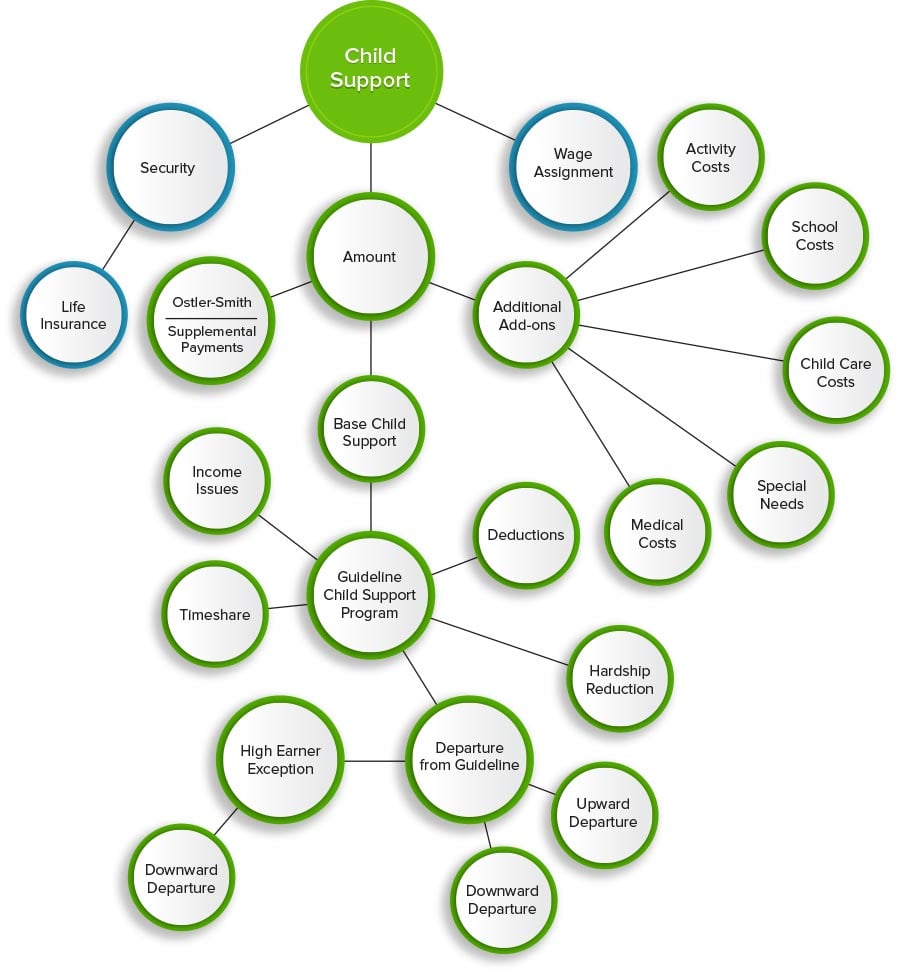

What is Guideline Child Support?

What is Guideline Child Support?

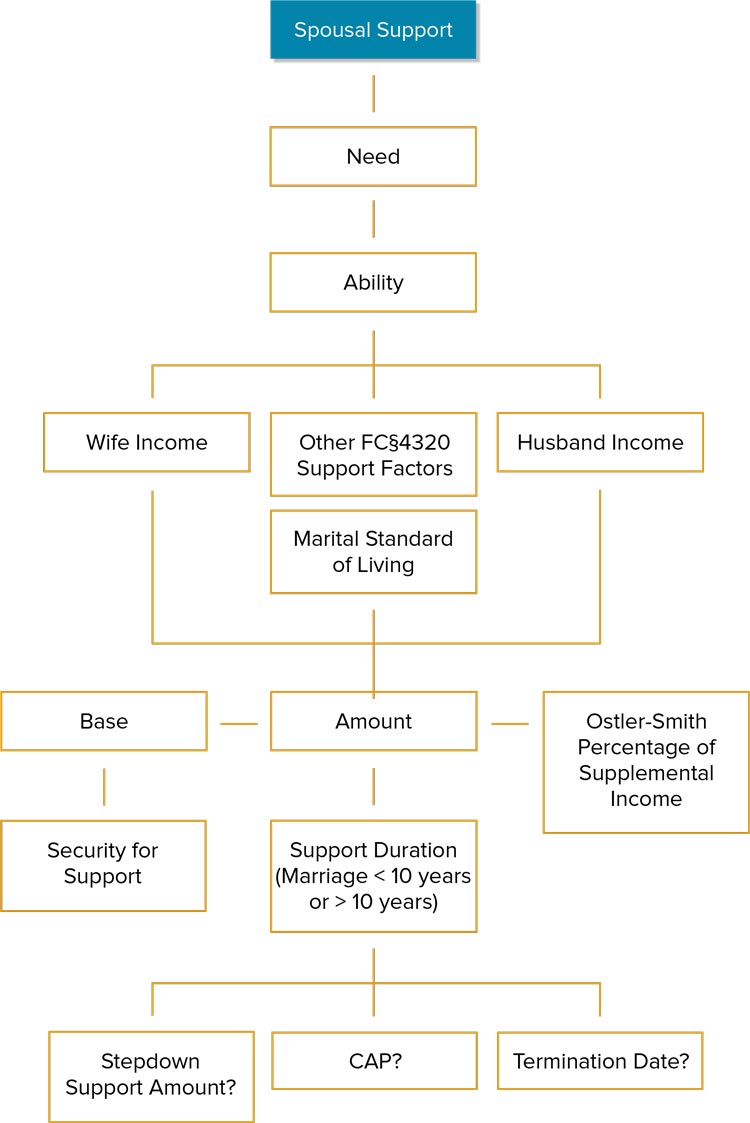

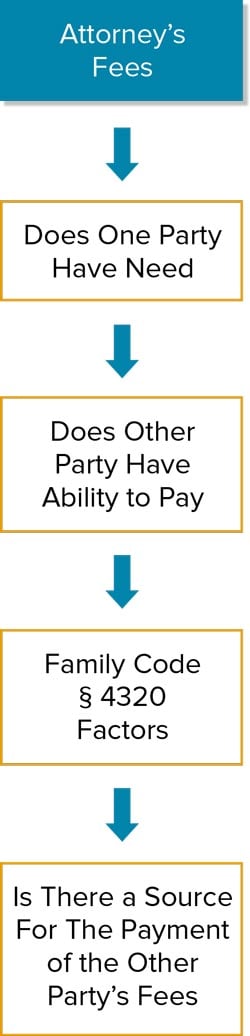

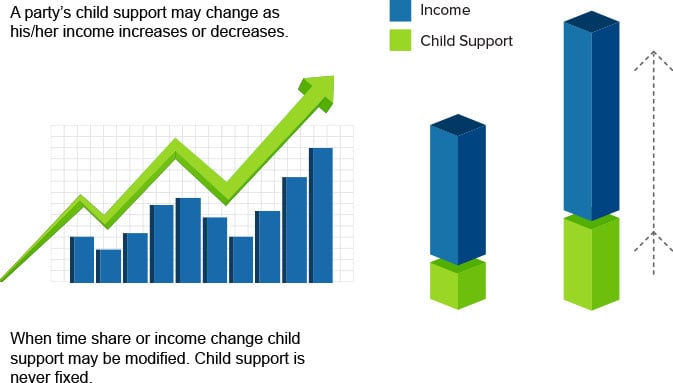

California family law states that parents must contribute to the support of a child, according to a detailed formula utilized in the software programs “X-Spouse” and “Dissomaster.” These programs generate “guideline” child support.

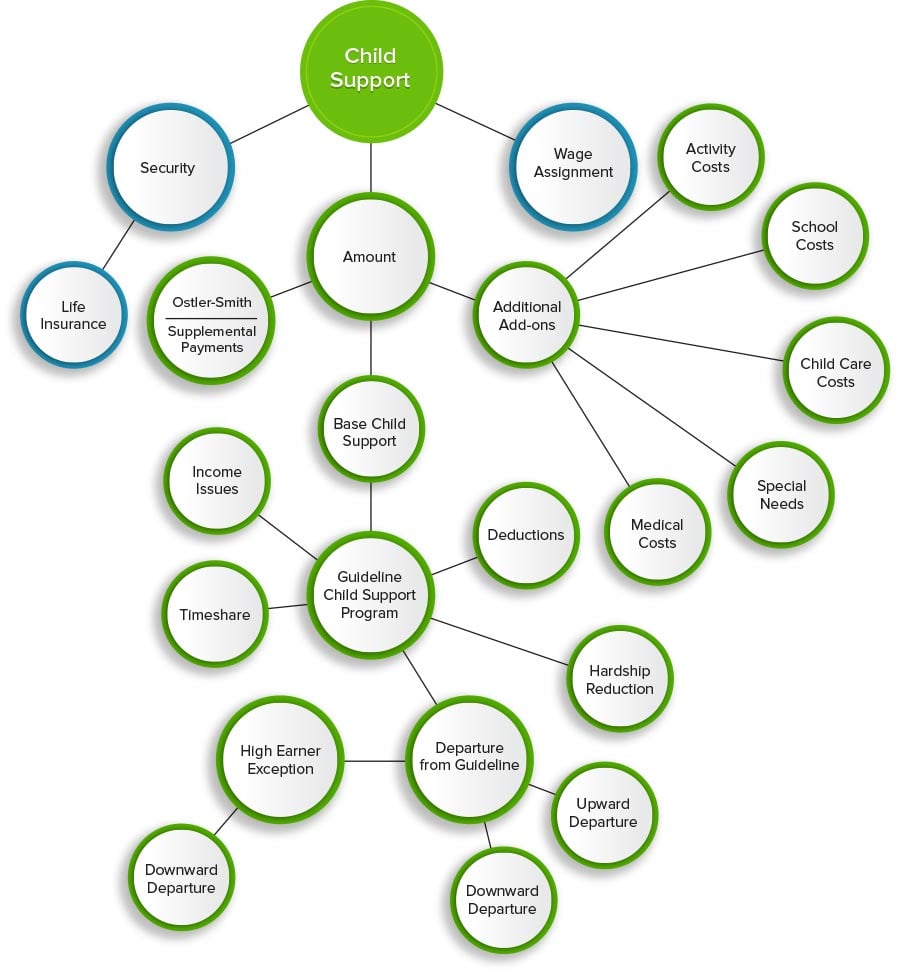

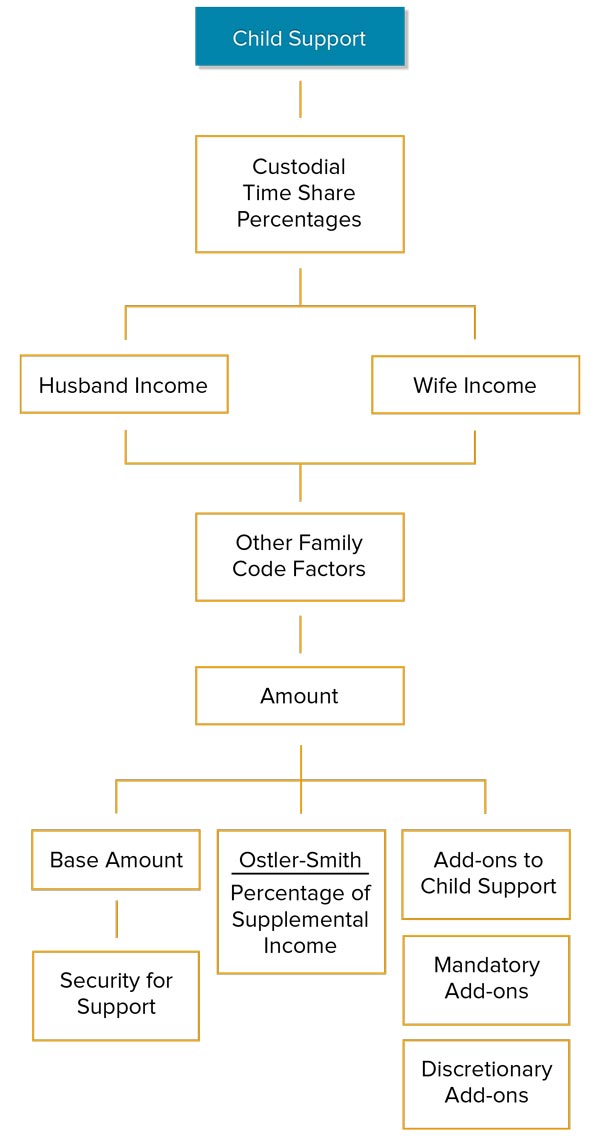

Child Support Decision Tree

Family Law Interconnectivity Overview – Children

Child support is more involved than simply inputting the incomes of the parties into a computer program and pressing enter. The computer program generates the guideline child support amount. A family court may order a party to pay for additional expenses, referred to as “add-ons,” in addition to the base child support. Add-ons may include such things as child care, activity costs, schools costs, travel costs, health insurance premiums, and medical costs not paid by insurance. Other issues that may need to be addressed include imputation of income, determining the representative period of past earnings to determine the most probable future income, how to treat fluctuating income, determining whether money received is income, etc.

A family court may order “add-on” costs be paid in full by one party, or divided between the parties in equal or unequal shares.

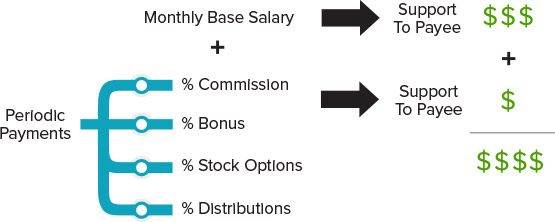

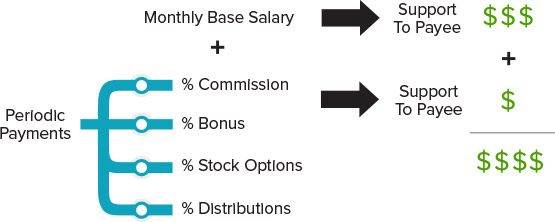

A family court may order a base level of child support, and a supplemental payment of any additional income received over the base salary. This supplemental child payment is referred to as an “Ostler-Smith” payment.

Isn't Child Support Determined by Simply Using a Computer Program?

“Child Support Decision Tree

Family Law Interconnectivity Overview – Children

Child support is a complex area of family law and is more involved than simply inputting the incomes of the parties into a computer program and pressing enter. The computer program generates the guideline child support amount. A family court may order a party to pay for additional expenses referred to as “add-ons” in addition to the base child support. Add-ons may include such things as child care, activity costs, schools costs, travel costs, health insurance premiums and medical costs not paid by insurance. Other issues that may need to be addressed include issues like imputation of income, determining the representative period of past earnings to determine the most probable future income, how to treat fluctuating income, determining whether money received is income, etc.

A family court may order “add-on” costs be paid in full by one party or divided between the parties in equal or unequal shares.

A family court may order a base level of child support and a supplemental payment of any additional income received over the base salary. This supplemental child payment is referred to as and “Ostler-Smith” payment.

Can Parties Agree to a Non-Modifiable Child Support Order?

The parties cannot contract with each other to deprive the family law court of jurisdiction to order or modify child support for a minor child or disabled adult child. Such a contract would be void and against public policy (IRMO Lambe & Meehan).

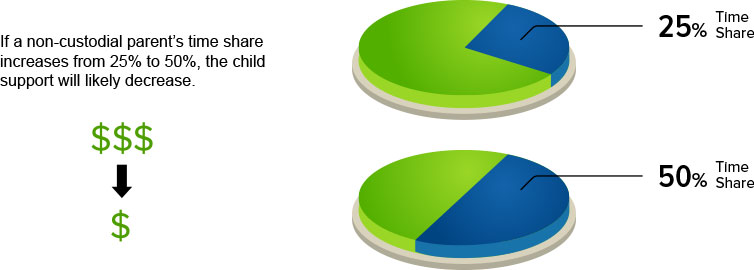

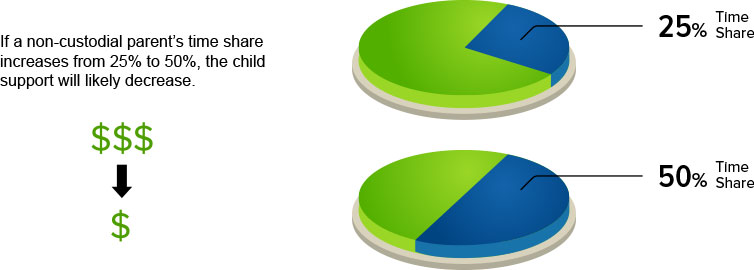

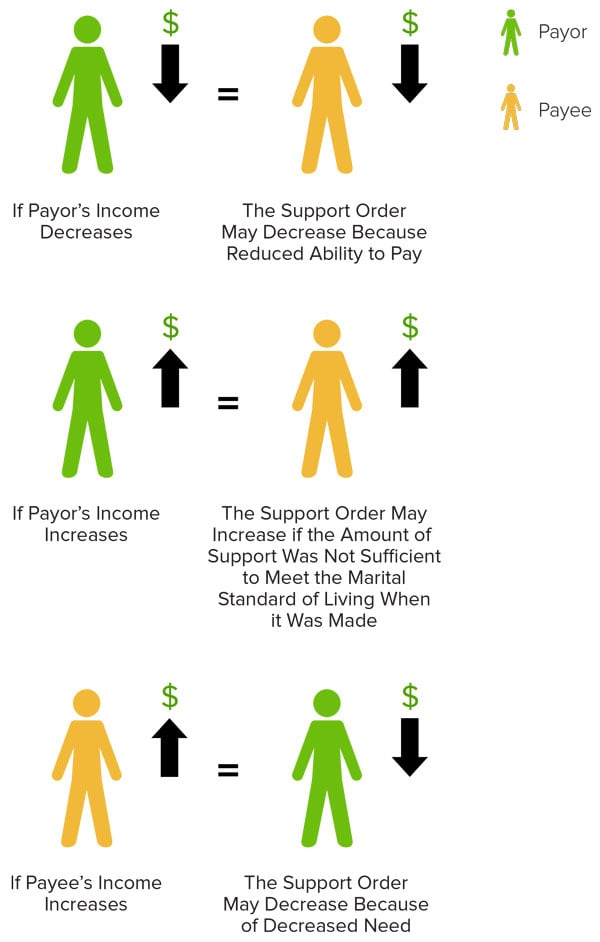

Is the Amount of Custodial Time That Each Parent Has Relevant to the Amount of Child Support?

“Child Support

Conflicts may exist relative to the methodology of calculating custodial time sharing. Generally, hours of parental responsibility are counted towards the time share percentages. This means that when a child sleeps at one parent’s home, that parent is credited with the sleep hours in the time share calculation. Likewise, if one parent is responsible for issues that arise during the school day, that parent is credited with the school hours. One of the significant factors that determines guideline child support is the child custody time share percentages. A higher child custody time share for the payor decreases child support, and a lower child custody time share for the payor increases child support.

Is Guideline Child Support Determined by a Computer Program?

“Child Support

The amount of child support is determined by state mandated guidelines using a formula that factors in each party’s income, and the percentage of time that a child spends in the custody of each parent. Family law courts use one of the computer programs (Dissomaster, XSpouse, etc.) certified by the state to arrive at “guideline” child support.

Is There a Difference in the Determination of Guideline Child Support at the Temporary Stage vs. the Post-Judgment Stage?

Potential Sequence of Steps and Procedural Events in a Divorce

Temporary child support is ordered at the Request For Order (RFO) stage of the case. Post-judgment child support, is ordered at the trial. Guideline child support ordered at both stages of a case, is determined by the same formula.

Is the Court Required to Order the Computer Generated Child Support Amount?

A family law court may depart or deviate from guideline child support, even though the amount of guideline child support is presumed to be the correct amount. A family law court has the discretion to determine whether or not to depart from guideline child support but must make specific findings to justify the departure (IRMO Hall).

The following circumstances may justify departure from guideline child support:

- Special needs of a child (IRMO Cryer);

- Exceptionally high earner;

- Deferred home award to payee party;

- A party is not contributing to the needs of the children at a level commensurate with their time share;

- Unjustness of the guideline formula in the particular circumstance;

- Payment of significant amount of community consumer debt incurred for basic living needs (County of Lake v. Antoni); and

- Mortgage free housing. (IRMO Schlafly).

A client should expect their divorce lawyer to be beyond candid, and explain to them the strengths and weaknesses of the case, and the probable outcome of litigation at the first attorney-client meeting and at every stage during the process, as new facts unfold. A client should have the opportunity to make informed and timely decisions about their children. Our Orange County divorce lawyers are known for telling our clients the good, the bad, and the ugly about child custody matters – early and often. Clients deserve to hear the truth, not a sales pitch.

How is Time Share Calculated in Setting Guideline Child Support?

The custodial time awarded to each party impacts the amount of child support calculated by the guideline formula.

A divorce court has the discretion to use approximate percentages in setting the custodial time share (IRMO Rosen and IRMO DaSilva). Alternatively, a court may literally count the hours and calculate the exact actual time share.

A divorce court may attribute timeshare credit to a party while a child is actually attending school (IRMO Whealon and IRMO Katzberg) or sleeping, if the party is responsible for the child during those hours.

Are a Child's Special Needs Relevant to a Child Support Order?

Child support is paid to address a child’s needs. A divorce court may take into consideration the special needs of a child when determining the amount of child support. The court may also consider the history of private school attendance and the reasons for private school. A child support order that merely pays for a child’s necessities may not be sufficient, if the parents can afford to pay for more.

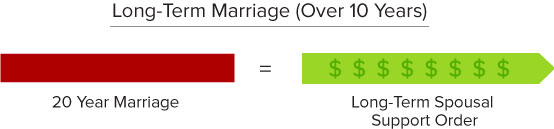

When Does Child Support End?

Child support is payable until a child completes high school, but not after a child attains the age of 19.

Child support does not automatically end on the death of the payor parent, even if the primary parent had child custody. (IRMO McCann).

Child support may be payable to adult children who are unable to support themselves.

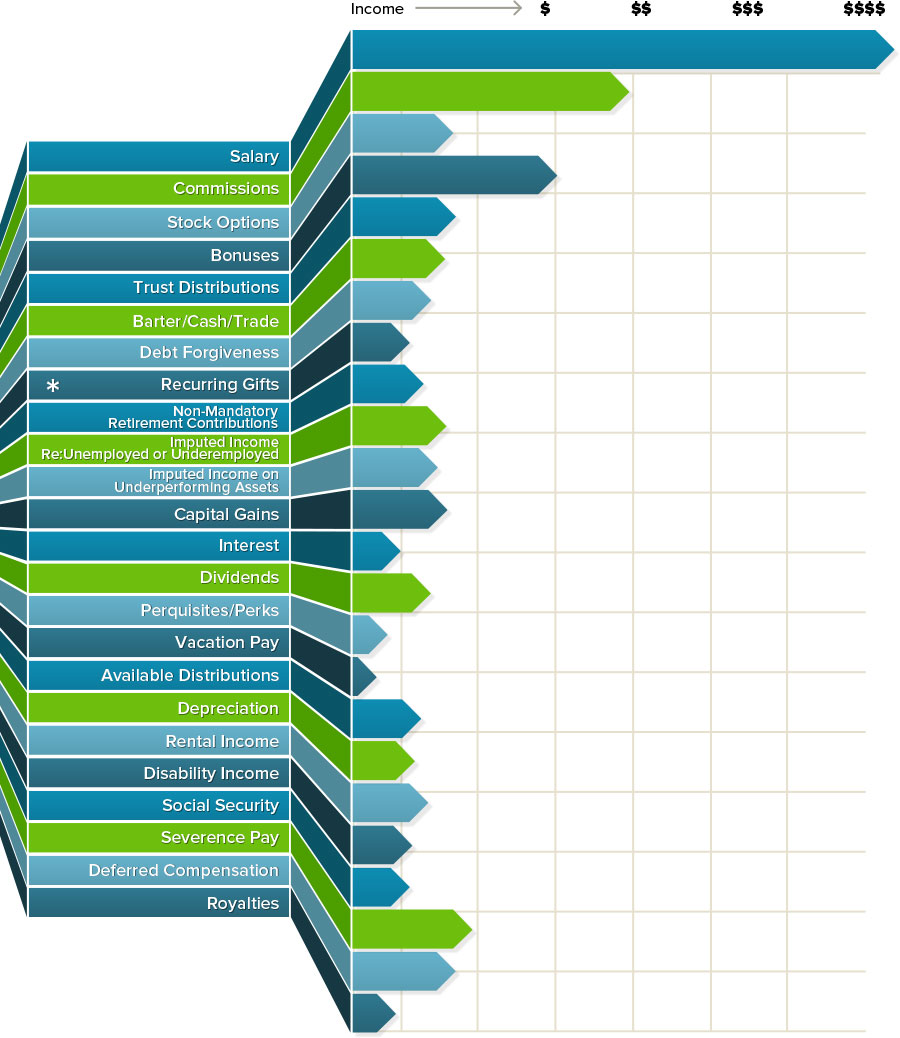

What Sources of Revenue are Included in the Guideline Child Support Calculation?

Child support is based upon the gross (not net) income of the parties, including the following types of income and benefits:

- Salary;

- Bonuses;

- Royalties;

- Rents;

- Workers compensation;

- Unemployment benefits;

- Disability benefits;

- Social Security benefits;

- Employment benefits;

- Deferred income;

- Perquisites;

- Military allowances;

- Meal allowances;

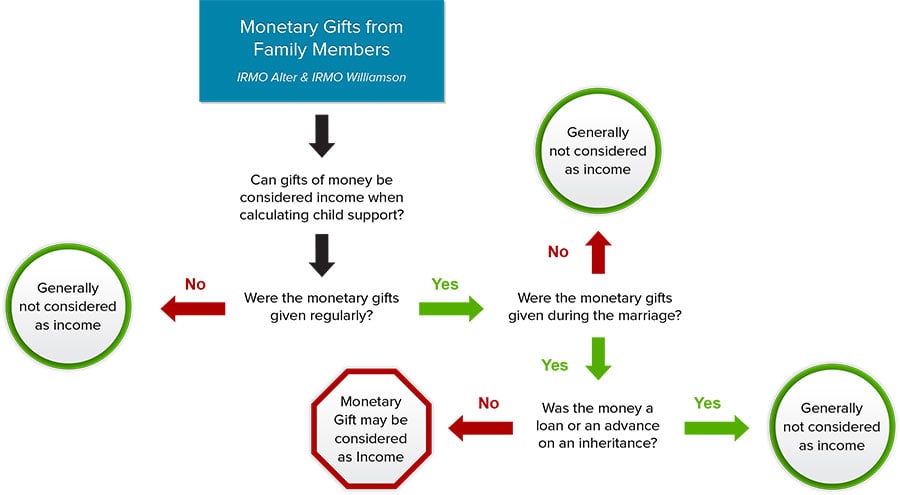

- Recurring Gifts;

- Most annuity payments; and

- Vested stock options/RSUs/Profits Interests.

The following items are not income available for child support:

- One time inheritances;

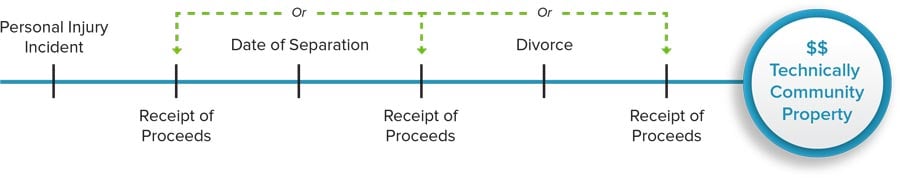

- Unallocated lump-sum personal injury recoveries;

- Loans of all types including student loans;

- Life Insurance proceeds; and

- Proceeds of the sale of stock in a business that are reinvested.

What Other Issues Does a Court Look to in Determining Income Available for the Payment of Child Support?

A family law court may look to the parents income and assets in determining the amount of child support.

Structured annuity payments paid relative to a personal injury do not constitute income for the purposes of determining child support.

Spousal support is not income to be included in the calculation of guideline child support. (IRMO Corman).

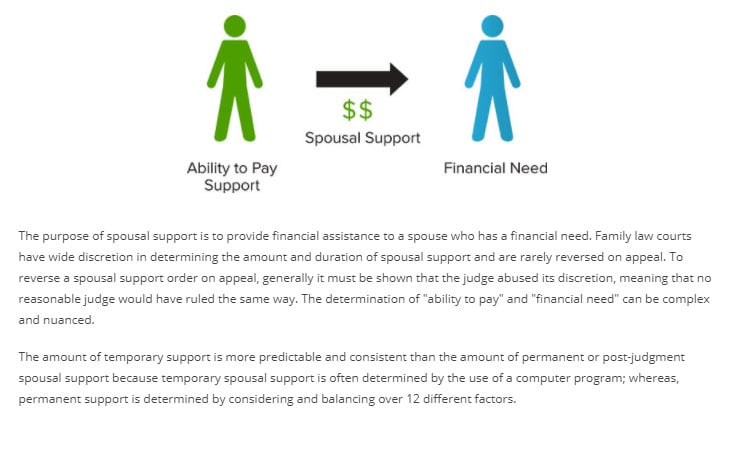

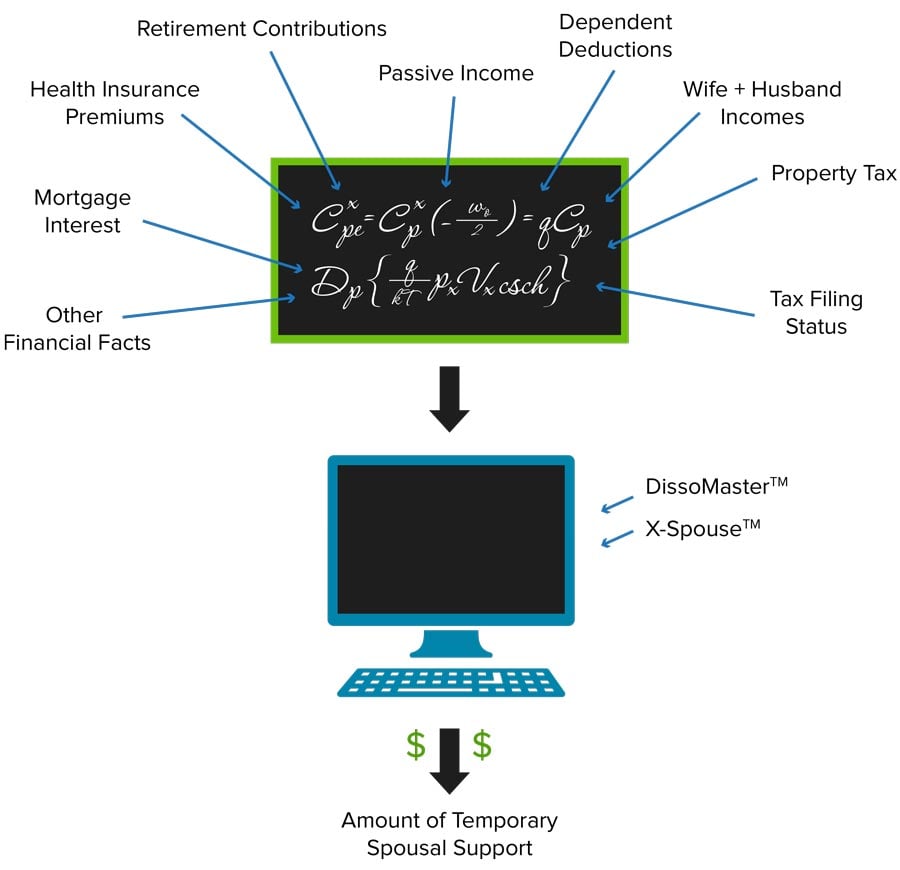

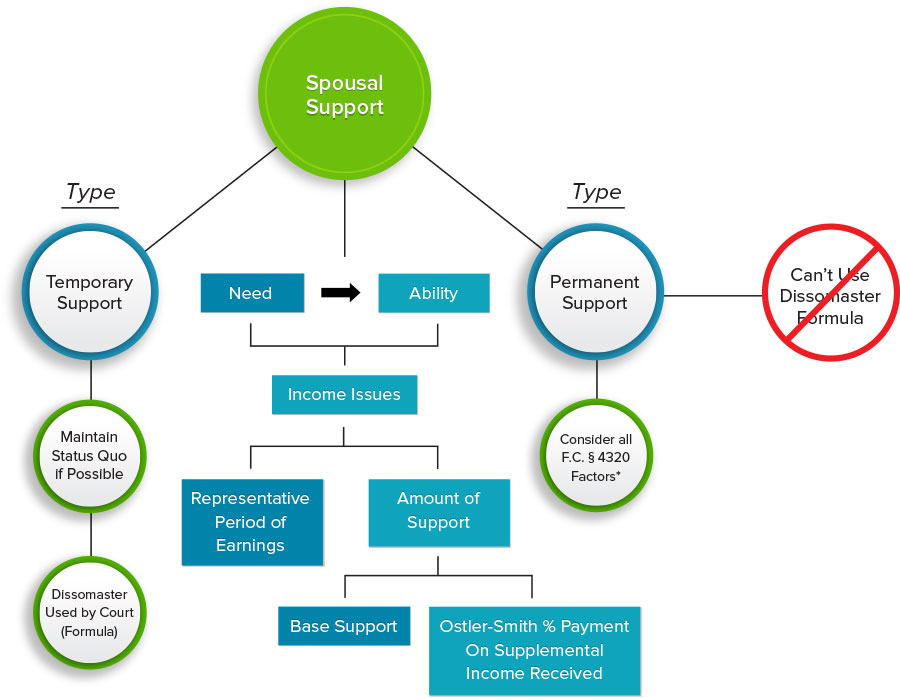

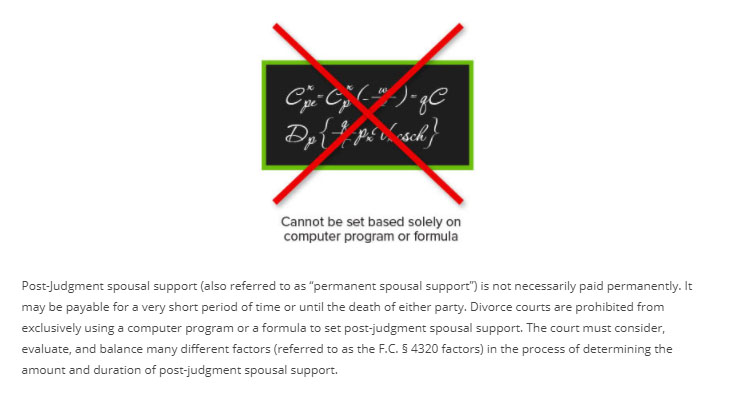

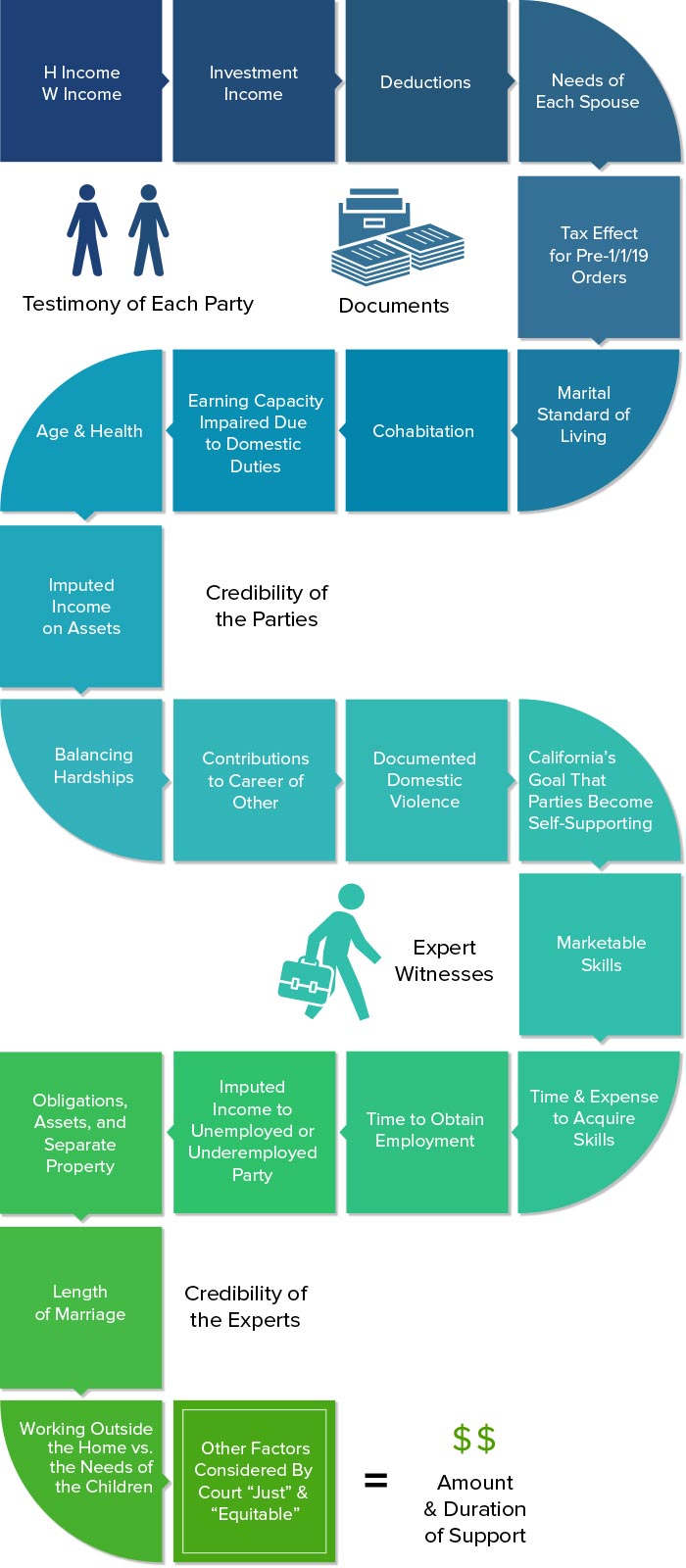

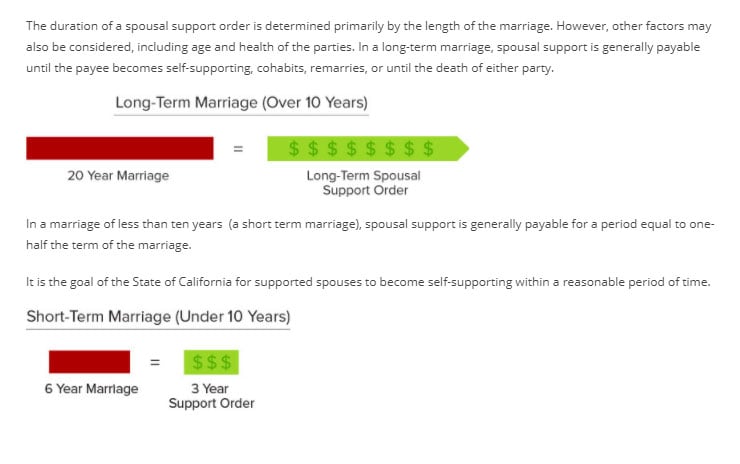

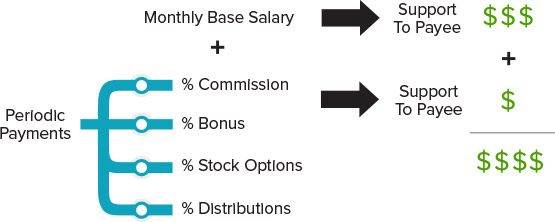

A wealthy party may avoid extensive discovery if a stipulation is reached providing that the party has the ability to pay any reasonable child support. (Estevez v. Superior Court and IRMO Aylesworth).