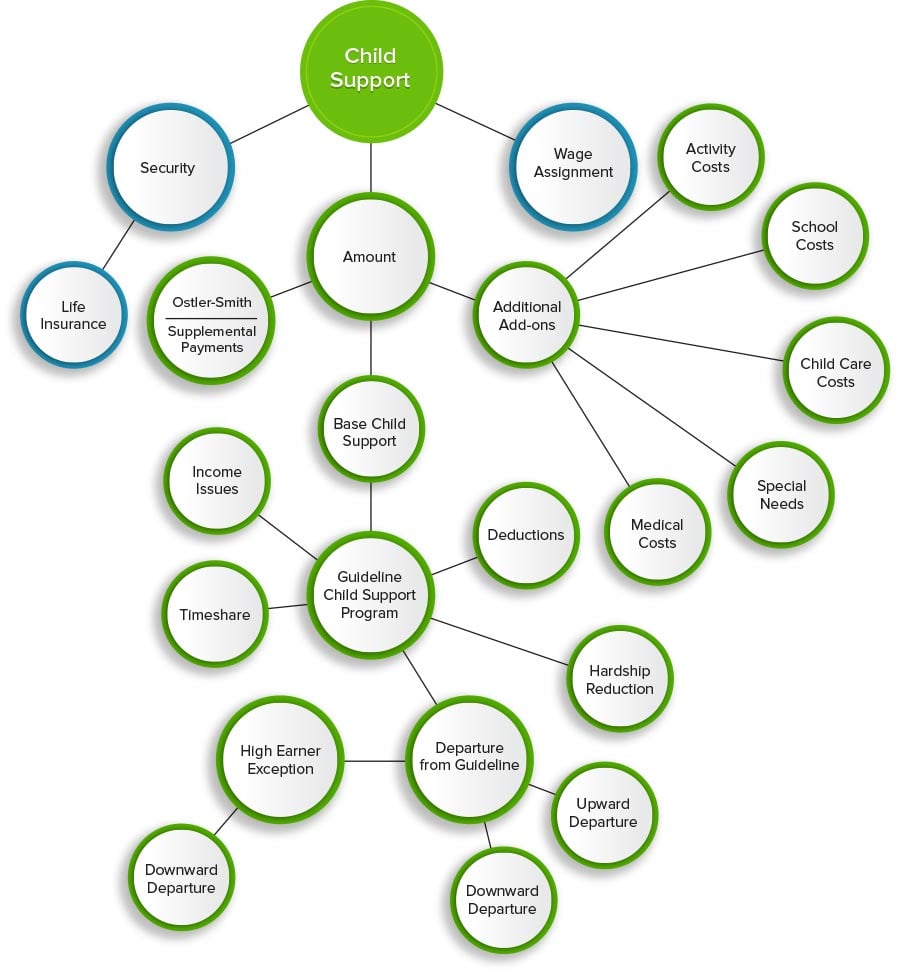

Child Support Overview

What is Guideline Child Support?

Guideline child support is calculated with the use of a computer program that requires the input of a number of factors. The most significant of which are custodial timeshare and income (as defined by the Family Code).

The purpose of child support is to provide a level of support that allows the child to share the parent’s economic station in life.

Child Support

Guideline child support is determined by a computer program. The parties may agree to pay an amount of child support that differs from the computer-generated amount if they so choose. However, the court will not recognize or approve a written agreement between the parties that child support be fixed and non-modifiable. Child support is always modifiable when circumstances change even if the parents have agreed in writing that it will not be modifiable.